AU SFB launched several initiatives to strengthen its digital proposition, which is scaling well:

AU Small Finance Bank has recently completed 6 years as a small finance bank and 28 years as an institution. Sanjay Agarwal, MD & CEO, and Uttam Tibrewal, Executive Director, AU Small Finance Bank, throw light on the bank’s digital journey so far and the path ahead at the recent earnings call conference and investor presentation.

Innovative Digital Products

In wheels business, AU Bank is implementing Salesforce’s LOS along with underwriting tool by FICO to enable straight through processing of vehicle loans. When the bank started this journey from its oldest business, it envisaged implementing similar processes for all the loans in the bank.

Key IT highlights of the bank include upgrade of its core banking system, enhancing data centre capacity and scaling its digital propositions further. The bank has been working across all aspects of technology, be it core technology stack digitization, automation, data analytics and digital customer facing propositions. Agarwalinforms: “On the digital front, we continue to deliver innovative products and upgrade existing offerings. We have recently launched a Digital Current Account, Swipe Up Card, Credit Card Upgrade Program and industry-first offering around bill payments over video banking. Our digital insurance and wealth proposition have also started gaining traction and this year we would further enhance and scale this. We will also be soon launching a merchant app. Our tech outlook remains very strong.”

Automation, Data, Investment

In line with its commitment to innovation and customer centricity, AU Small Finance Bank continues to make huge investments. Its investment rose from Rs 2.57 bn in FY22 to Rs 5.06 bn in FY23. The key areas were funds were deployed are credit cards/QR/video banking (70%), distribution expansion (19%) and brand campaign (11%). The bank has been investing in strengthening the digital franchise, building digital capabilities for the future (credit cards, merchant solutions, video banking), expanding its distribution and branch franchise, and investing in brand building. Such investments accounted for 15% of total opex in FY23 vs 11% in FY22.

Tech is a key focus area for AU SFB. It recently upgraded its core banking to the latest version of Oracle and also started migrating some of its workloads to cloud. This quarter, the bank made significant progress in strengthening its core technology stack. The bank is also upgrading capacity of its data centres. Its priority remains to build efficiency and productivity through automation and increase the share of STP with a customer first approach.

A major step towards operational excellence is to automate processes using robotic process automation and AI. As bank’s are the golden source of data, those with capabilities to leverage data to personalize customer experience will stand as winners. Agarwal says: “I personally believe that in next 10 years, every Indian will have a digital footprint and that will generate large datasets. At AU, we’re enhancing our understanding of customer through in-house and alternative source of data for the long-term vision to have a customer data as good and as vast as what Google has, keeping in view all required norms around privacy and data protection.”

Video Banking, Credit Card

AU SFB’s video banking channel has evolved into a comprehensive and self-sufficient digital franchise offering 400+ services and handling over 1000 customers calls per day. For credit cards, the journey of the bank’s sourcing through video banking started in October 2022. And in less than 6 months it issued over 0.1 million credit cards via this channel. AU SFB is the first small finance bank in India to issue its own credit card.

AU SFB’s video banking channel has evolved into a comprehensive and self-sufficient digital franchise offering 400+ services and handling over 1000 customers calls per day. For credit cards, the journey of the bank’s sourcing through video banking started in October 2022. And in less than 6 months it issued over 0.1 million credit cards via this channel. AU SFB is the first small finance bank in India to issue its own credit card.

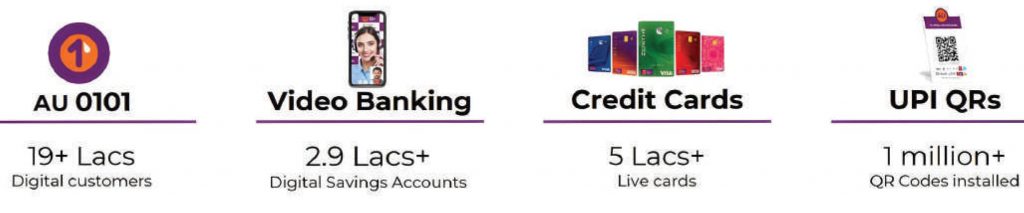

The bank has started acquiring current accounts using video banking starting April 2023 and it is confident to get a similar success on this journey too. 48% of new customer acquisitions in Q4’FY23 were via digital products – digital savings account, credit cards and UPI QR.

Uttam Tibrewal, Executive Director, Au SFB, updates: “Our acquisition of savings from customers via the video banking channel grew 100% during the FY2022-23 with 0.29 million plus customers having over `11.50 billions of deposits and 15% of customers also holding an additional product. Our overall credit card proposition now goes more than 0.5 mn cards and a monthly issuance reached 50,000 plus cards, with monthly spends reaching Rs 10 bn in March 2023.”

UPI QR: Payments, Lending, App

AU SFB is also enhancing its digital payment stack with more powerful propositions around UPI, BBPS, Fastag, etc. On the merchant side, the bank has reached the milestone of 1 mn UPI QR codes. UPI QR transactions have doubled over the past year.

The bank saw close to Rs 2 bn in merchant lending till Q4FY23. QR based lending solution has also seen a good start. Tibrewal points out: “UPI QR transactions reached 4 mn in March’23. Also, we disbursed Rs 1.46 bn in personal loans in Q4FY23 with total disbursement of Rs 8.04 bn, all through the AU0101 digital platform. Our AU0101 app saw 90% growth in user base registration to 1.9 million customers, with more than 1 mn active users in March 2023.”

Web Traffic Growth

During FY23, AU Bank added 108 new touch points to expand its distribution to a total of 1027 touch points and serving its customers physically from 711 unit-locations across 21 states and 3 union territories. The success in digital acquisition and engagement of AU SFB is also attributed to the growth in brand awareness with over 310 mn brand impressions and more than 160 mn website visits in Q4FY23. Tibrewal states: “Not only did the branch search volume increased by 30% in the last FY, but the website traffic has also grown by 2.7X y/y with 50% lift in organic traffic, translating to growing brand affinity towards the bank. We have also witnessed 200% growth in number of digital customers reaching our website to explore products and enable services.”

During FY23, AU Bank added 108 new touch points to expand its distribution to a total of 1027 touch points and serving its customers physically from 711 unit-locations across 21 states and 3 union territories. The success in digital acquisition and engagement of AU SFB is also attributed to the growth in brand awareness with over 310 mn brand impressions and more than 160 mn website visits in Q4FY23. Tibrewal states: “Not only did the branch search volume increased by 30% in the last FY, but the website traffic has also grown by 2.7X y/y with 50% lift in organic traffic, translating to growing brand affinity towards the bank. We have also witnessed 200% growth in number of digital customers reaching our website to explore products and enable services.”

Tech Partners, Tie Ups

Sanjay Agarwal’s focus areas are to build brands, strengthen deposit franchise, invest in innovation, data first as well as digital culture and to build a strong HR practice. He aims to build brands, which will eventually help the bank in deepening trust in the entire ecosystem. He lays emphasis on understanding customers, which he calls UYC.

Tech and innovation remain his top focus areas. AU Bank has been preparing itself to leverage the opportunities available through the emerging public digital infrastructure in India. The bank is live on the account aggregator. It is one of the first few banks to be live on the OCEN platform. It is also working with an RBI Innovation Hub fintech to enable financial inclusion.

Tech and innovation remain his top focus areas. AU Bank has been preparing itself to leverage the opportunities available through the emerging public digital infrastructure in India. The bank is live on the account aggregator. It is one of the first few banks to be live on the OCEN platform. It is also working with an RBI Innovation Hub fintech to enable financial inclusion.

To execute its vision, the bank has strengthened its tech team. It is working with leading global tech companies like Amazon, Salesforce, Accenture, Adobe, Oracle and NPCI. Agarwal indicates: “All these tech partners have been engaging well with us and I’m personally meeting their global leadership to further strengthen our relationship and to explore areas of innovation. We are in discussion with ONDC team to implement innovative use case around digital commerce. I’m investing a lot of my time these days in tech discussion with IT team partners and ecosystem stakeholders. We remain on a journey to build one of the best tech-led retail banking franchise for this country.”

Read more: