A Crisil-Oister Report highlights the importance of AIFs in India’s financial market system and says this investment medium has gained prominence:

The second edition of the Crisil-Oister Report, titled ‘No ifs about AIFs 2.0’ says the benchmark of equity Alternative Investment Funds (AIFs) investing in unlisted securities achieved a remarkable pooled internal rate of return (IRR) of 21.5% between fiscals 2013 and 2024. It said across the past 5 fiscals, the benchmark outpaced the BSE Sensex Total Return Index (TRI), reaffirming the resilience and importance of private markets in India’s investment landscape.

The report highlights the exceptional performance of equity AIFs in the country, and examines the evolving role of private markets in driving economic growth, showcasing the success of early-stage funds with a 26.4% IRR and the dominance of late-stage deals. The report also looks key sectors like fintech, climate tech and deep tech, emphasizing private capital’s critical role in fostering innovation, resilience and scalability across the nation’s investment landscape.

GROWTH BENCHMARKS

The report says stage-wise, the benchmark of early-stage funds generated a pooled IRR of 26.9% between fiscals 2013 and 2024, outperforming the BSE 250 Smallcap TRI by 4.29%. Similarly, the benchmark of growth and late-stage funds delivered a robust pooled IRR of 23.6% between fiscals 2015 and 2024, surpassing the BSE 200 TRI by 5.97%.

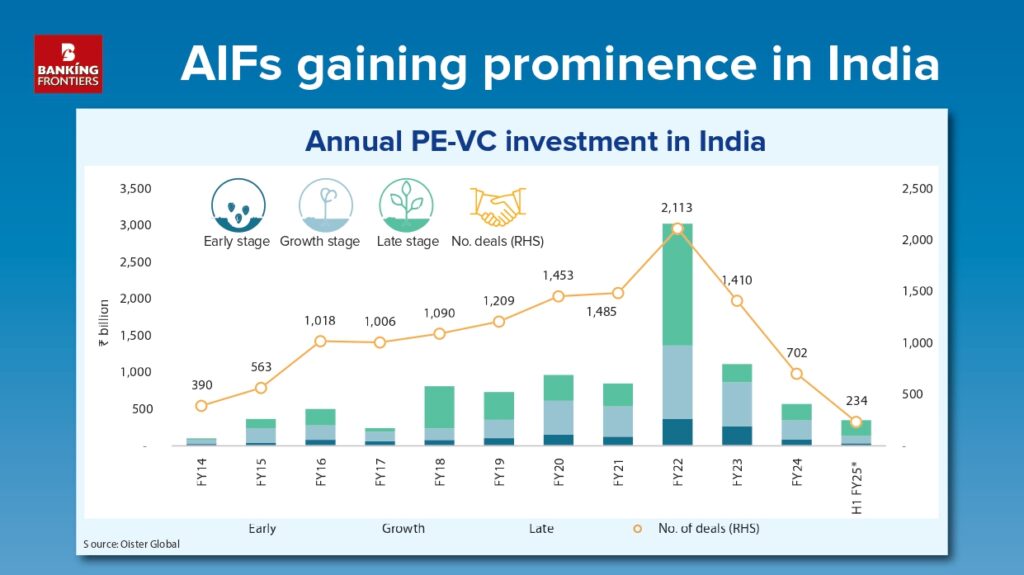

According to the report, late-stage and big-ticket deals form a significant share of private market equity deals, reflecting the increasing maturity of India’s private market ecosystem.

“In fiscal 2024, late-stage transactions accounted for 39% of the total equity deal value, compared with 18% in fiscal 2014, reflecting a market focused on scalability and predictability,” states the report, and adds that “In comparison, big-ticket deals, or those exceeding Rs500 million each, captured 90% of the total value despite constituting only 28% of the total transaction volume, underscoring their potential to deliver robust returns.”

It points out that highlighting innovation beyond metros, non-tier I cities accounted for 8% of deal volume in fiscal 2024 and clocked a CAGR of 24% in value terms between fiscals 2014 and 2024.

“Financial services and financial technology sectors captured 17% of deal value, driven by India’s digital financial leadership. Meanwhile, the share of climate and related technology grew to 7% in 2024 from 1% in 2014, reflecting increasing global emphasis on sustainability,” the report says.

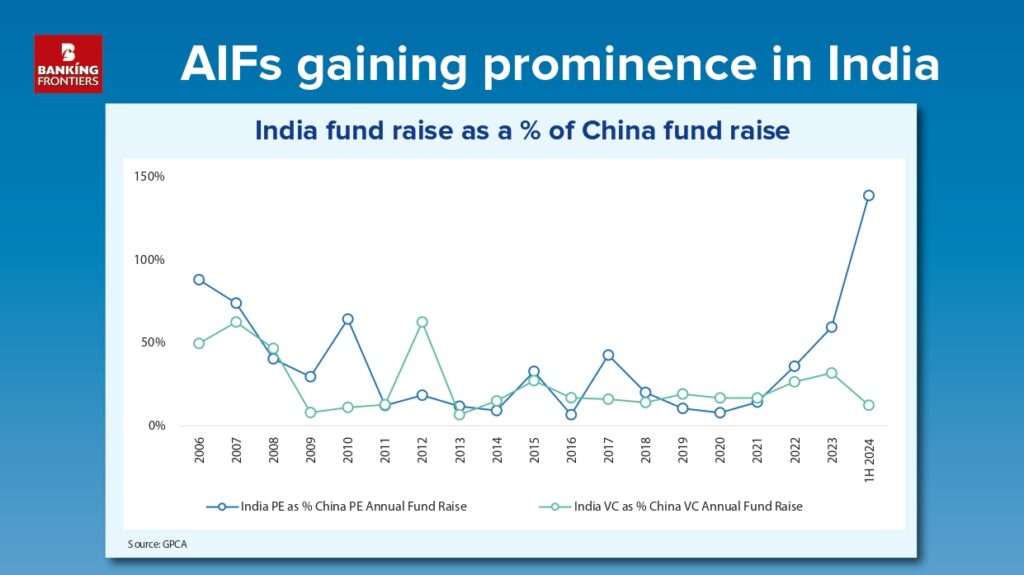

PE, VC INDUSTRY GROWTH

Discussing ‘India’s PE and VC industry – the new growth frontier’, the report states that investments by PE and VC firms in the country are growing like never before, fuelled by numerous factors being witnessed by the Indian economy. “Despite global economic headwinds,” states the report, “investors are optimistic about India’s growth prospects.”

The report also highlights that burgeoning startups are playing a key role in helping India become a global economic leader. “Investments in startups have increased 15 times from 2015 to 2022. As per Department for Promotion of Industry and Internal Trade (DPIIT) data, India is now home to the world’s third-largest startup ecosystem with over 151,000 recognized startups as on 21 October 2024. The startups segment logged a CAGR of 34.5% between fiscals 2019 and 2023 based on the DPIIT data,” states the report.

The report says consumption-led growth coupled with robust government policies are driving investments in India and it remains an attractive investment destination which is business-friendly. While early-stage deals continue to account for the largest share of the PE-VC investment pie by volume, its proportion of investment in terms of both volume and value has declined. These deals accounted for 86% of the total volume in fiscal 2014 (24% in terms of value) but constituted a much lower 70% of the total volume in fiscal 2024 (16% in terms of value). Nevertheless, early-stage investments have logged 4% and 14% CAGR in terms of volume and value, respectively, in the past 10 years, says the report.

FUNDING IN FINTECH

Resurgence of funding in the fintech industry as a result of rising adoption of digitization and supportive government policies is assisting India in becoming a global fintech hub, emphasizes the report. It adds digital-only banking, mobile wallets and other technology-linked innovations have revolutionised traditional financial services.

According to the report, Alternative Investment Funds, or AIFs, mandated under the SEBI (Alternative Investments Funds Regulations, 2012, is transforming the PE-VC industry in India. It says AIFs have emerged as one of the fastest-growing managed investment product segments and is an attractive asset class for investors seeking to tap the country’s private markets.

AIF GROWTH STORY

There were 1271 registered AIFs across 3 categories in the country – 286 AIFs under Category I, 734 under Category II and 251 under Category III. Category I and II constituted 80% of total registered AIFs. About 54% of Category I and II AIFs were registered between April 2020 and March 2024, indicating the AIF industry’s increasing traction.

The report says the total commitment across the AIF industry increased ~87 times from Rs131 billion as on 31 March 2014, to Rs11,349 billion as on 31 March 2024. Total commitment raised by Category I and II AIFs stood at ~Rs769 billion and Rs9129 billion, respectively, as on 31 March 2024.

The report states that the AIF industry has grown significantly in recent years, driven by regulatory reforms, increasing investor interest and a robust economic environment. “The industry is maturing rapidly and, as the investor base widens, AIFs are poised to become a cornerstone of India’s investment landscape,” predicts the report.

HOW AIF CAN GROW

The report says investments by domestic institutions like EPFO and NPS in AIFs could significantly contribute to the growth of India’s AIF industry in the coming years.

Also, the growing economy and robust performance of capital markets have led to a surge in the number of HNIs and family offices. These investors are seeking to diversify their portfolios beyond traditional assets, driving demand for alternative investment options, says the report, adding AIFs have emerged as an important product for portfolio diversification as it provides an ideal gateway to private markets and the start-up ecosystem in India.

While many domestic institutions historically preferred fixed-income securities their investment guidelines permit them to allocate a portion of their annual investments in Category I and II AIFs, subject to certain conditions, says the report, adding, as of March 2023, while the EPFO and the NPS had not made any investments in AIFs, insurance companies have invested in Category I and II AIFs, though the investment amount is still below the permissible limit.

“This suggests there is significant potential for increased flows into AIFs from these domestic institutions, as they continue to explore diversification opportunities,” the report adds.

The report also highlights that as of September 2024, foreign investors accounted for ~49% of gross funds raised across Category I and II AIFs.

TECH SECTORS ATTRACT INVESTMENT

The Crisil-Oister Report ‘No ifs about AIFs 2.0’ states that the fast pace of innovation and entrepreneurial spirit are unlocking unique opportunities in climate, environment, renewables and related technologies. In the past few years, this sector has been able to appeal to investors and additional government push towards green revolution has increased its share in value of deals from 1% in fiscal 2014 to 7% in fiscal 2024.

The report says segments like deep tech, or business areas such as artificial intelligence, Internet of Things and advances in biotechnology, were perceived to be a risky investment in the country a few years ago. However, this trend has changed significantly and is attracting both PE and VC investments, both domestically and from overseas.

“The exponential rise in deep tech is evident from the fact that PE and VC investments in deep tech in India logged a CAGR of ~28% between fiscals 2014 and 2021, with investments increasing from Rs3 billion (19 deals) to Rs17 billion (132 deals),” says the report, adding: “In fiscal 2022, deals thrived in the deep tech space, with a total funding of Rs102 billion across 153 deals. Fiscal 2023 and fiscal 2024, however, saw a decline in both deal value and volume on-year, mirroring the global trend. Nevertheless, in first six months of fiscal 2025, deep tech propelled 21 deals.”

Recent Articles:

EC tests the prowess of DLT through a sandbox