A recent study evaluates the importance of AI in insurance sector:

A research study by the Geneva Association shows Artificial Intelligence is reshaping business processes in insurance. The study, titled ‘Regulation of Artificial Intelligence in Insurance’ highlights AI’s potential to help reduce protection gaps by improving the availability, affordability and accessibility ‘on the back of increased personalization and improved cost-efficiency’.

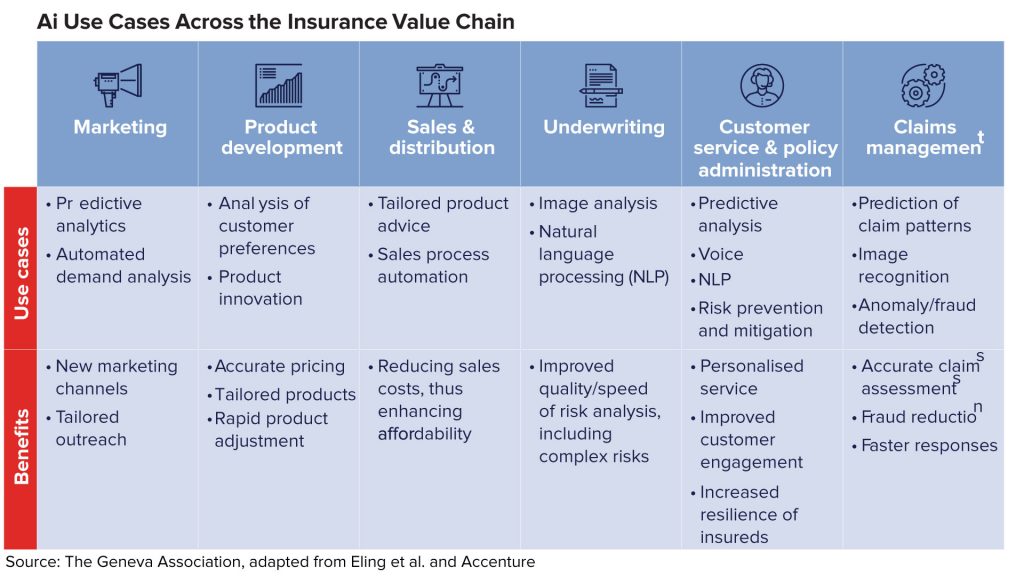

While AI can be applied across the insurance value chain, the study mentions specific use cases such as speech recognition, pattern and image recognition and data-driven decision making. “Depending on the area it is used, it provides customers with an enhanced and more tailored experience, innovative products, such as use-based insurance, and fast and efficient claims processing. It allows insurers to enhance their value proposition, by being able to predict and prevent risks, and thus helps societies become more resilient, improve fraud detection, and have a more granular view on risks,” says the study.

The study says while AI is not changing the core business of insurance, it is strengthening underlying processes. For example, it is strengthening underwriting by allowing rapid data processing and analysis capabilities, finding correlations, tapping new sources of data and allowing underwriters to make more accurate risk assessments.

AI HIGHLIGHTS CONCERNS

The study points out to major concerns that affect insurance sector such as lack of transparency and explainability, discrimination, bias, unfairness, unaffordability, exclusion and data-related issues, which are getting highlighted as a result of the use of AI. And insurers are today adopting various measures to address AI-specific risks, such as methodologies for detecting and preventing unwanted correlations in AI models, following AI governance principles such as those issued by EIOPA, self-imposed limitations on the number of rating factors used in underwriting, and governance structures tailored to manage AI-related risks, it adds.

The study also discusses public concerns about the risks and downsides of AI that have put pressure on policymakers and regulators worldwide to take action, which has led to a variety of regulatory initiatives, some specific to insurance and others that are cross-sectoral, particularly in the European Union. “The latter could stifle innovation in insurance, as it does not consider the unique characteristics of the insurance business model and existing regulatory frameworks. In contrast, some jurisdictions have adopted a principles-based approach, issuing guidelines on how existing, technology-neutral regulations can be applied to manage AI-specific risks in insurance,” the study says.

Evolving specific and prescriptive AI regulations is like trying to hit a moving target, given the rapid pace of AI developments, says the study, and this poses the risk of regulations becoming quickly outdated, while limiting innovation.

QUICKER ACTIONS

Novel risks associated with the use of AI in insurance, according to the study, are the speed at which effects of AI can propagate as well as the scope of the potential consequences of their misuse. “Even in the absence of AI-specific regulation, AI in insurance is not in a vacuum; for example, it is already subject to data-protection and insurance-distribution regulation. When developing their approach to AI in insurance, policymakers and regulators should leverage and build on these regulations in order to strike the right balance between protecting consumers and enabling innovation,” says the study.

SUGGESTIONS TO REGULATORS

The study has presented certain recommendations for policymakers and regulators in this regard, which include:

- Carefully define AI to limit AI to self-learning applications, focusing on machine learning to avoid over-regulation of established practices in insurance.

- Apply existing regulations to update guidance on applying these regulations in an AI context.

- Develop principles-based regulations to provide the most promising approach to managing AI risks.

- Consider the specific characteristics of AI in insurance

- Focus on customer outcomes and not over-emphasize the regulation of individual rating.

- Collaborate internationally to develop use-case-specific guidance for AI in insurance.

Read more:

U GRO Capital: Aspirational Goal, Relentless Determination

IT, SME & service sectors drive employee health insurance