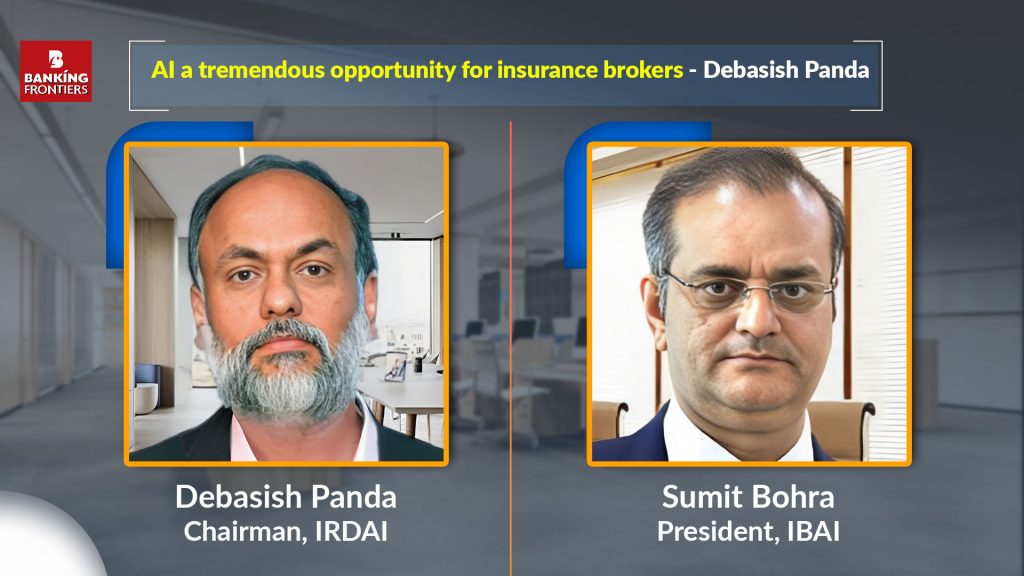

Debasish Panda, Chairman, IRDAI & Sumit Bohra, President, IBAI share the details about the changing roles of the brokers in the insurance industry:

As per the EV Vision 2025 report, insurance brokers are driving customer-centric growth. It expects insurance broking to contribute close to 40% of gross direct premium in non-life insurance in the progressive scenario. As per the report, non-life insurance market in 2025 is expected to be at Rs400 billion and the brokers market is likely to be around Rs160 billion.

Insurance brokers are the fastest growing distribution channels in India contributing to about Rs42.3 billion of gross direct premium in FY20-21 resulting in around 31% of the non-life insurance premium.

In the last financial years, India has experienced a surge in demand for insurance products and services, leading to a substantial increase in insurance penetration by insurance brokers. Brokers, while playing a bigger role in the distribution of non-life insurance in India, have doubled their share of premiums to over 35% from 17% over the last 10 years, and further plan to have a market share of 45% by 2030.

Global Scenario

As per the recent report global consulting firm McKinsey estimates, the global insurance brokers market is projected to grow to $300 billion in 2032. AI technologies alone will add $1.1 trillion in annual value to the global insurance industry. Debasish Panda, Chairman of the Insurance Regulatory and Development Authority of India (IRDAI) says: “This presents a tremendous opportunity for insurance brokers as they understand their customers and utilize tech-based mechanisms using AI/ML to communicate their preferences to insurers, resulting in highly tailored offerings.”

According to Panda, intermediaries must develop customer service platforms combining digital channels with personal advice, new products, and expertise. Such platforms should facilitate multiple quotes coverage comparisons, payment options, instant insurance policy downloads, and the ability to speak with insurance specialists throughout the process.

He cautioned: “Growing adoption of technology in the insurance industry will not cut the need for the intermediaries as the expertise and insightfulness of the brokers make them a critical link in the evolving marketplace.”

IBAI Contribution

The Insurance Brokers Association of India highlighted the industry’s robust growth trajectory and shared its vision for the future. Through collaborative efforts and strategic partnerships, the association aims to foster innovation, expand market reach, and promote consumer-centric practices within the insurance broking fraternity.

IBAI President Sumit Bohra commented: “The regulatory norms governing insurance brokers play a crucial role in supporting our industry. We appreciate the efforts made by regulators to create an enabling environment that fosters fair competition, transparency, and consumer protection. At IBAI, we are actively working towards creating a free market for all policyholders and we urge the regulators and industry people to join hands with us to bring forth this revolution. We aim to empower insurance brokers to navigate the changing landscape effectively and deliver enhanced value to their clients.”

Insurance Literacy & Awareness Campaign

IBAI announced the launch of a nationwide campaign during the Annual Broker’s Meet. This initiative aims to promote insurance education and empower individuals with the necessary knowledge to make informed decisions about their insurance needs. The campaign, slated to cover 500,000 students in schools and colleges across the length and breadth of the country, will focus on raising awareness about the various types of insurance, the benefits of insurance coverage, and the importance of financial protection.

The Insurance Brokers Association of India believes that by equipping students with insurance knowledge at an early stage, they will become more financially resilient and better prepared to navigate potential risks. The campaign will employ interactive workshops, seminars, and engaging educational resources to engage students and facilitate their understanding of insurance principles and practices.

The insurance broking business within the country is now matured with increased penetration, customized and diversified insurance products, a digital transformation, along with a conducive regulatory framework.

Sumit added: “As the insurance broking industry continues to grow and adapt to changing dynamics, IBAI remains committed to promoting industry excellence. Along with advocating for favourable regulatory norms, IBAI continues to focus on enhancing insurance literacy while championing causes that would ease the plight of policyholders.”

Read more: