An Accenture study says Asia has seen growth of the affluent and HNI pretty quickly and there is therefore unprecedented need for wealth management proposals:

Asia is poised to play a key role in the global future of wealth management, predicts a report by global consultancy Accenture. It says Asia, which today is the world’s most populous continent and the source of much of its economic dynamism, has seen the growth of affluent and high-net-worth population so fast that financial institutions are struggling to keep pace.

The report, based on original research by Accenture, says how wealth management firms should respond to the requirements of the ultra-rich in the area is debatable and these firms are now in the process of discussing how to transform their businesses in order to defend and grow their market share in Asia.

CRUCIAL ROLE OF RM

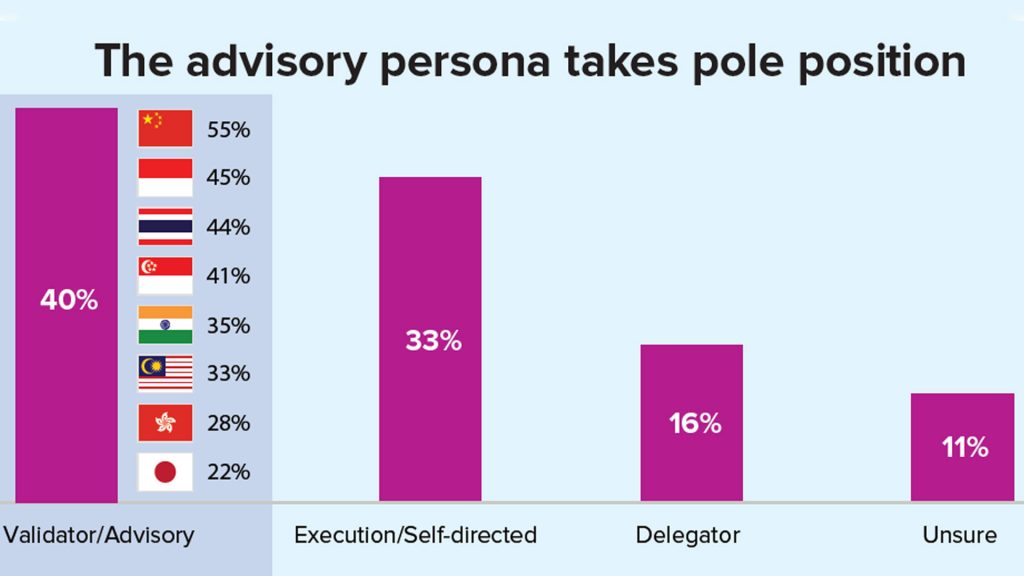

There are views that a wholesale transformation is unnecessary, because Asia’s investors are interested mainly in execution and have little interest in financial advice or strategy, and certainly no appetite to pay for such services, the study says, and adds that this mindset defines their relationships with their providers. However, the study hastens to add that this assumption is no longer accurate as it has been found that the biggest segment (40%) of clients in Asia are “those who wish to validate opportunities with their RM, even if they take the final decision for themselves – a grouping we refer to as the ‘advisory’ persona”.

The study adds that this shift can be attributed to the fact that markets have become volatile, and missteps can be painful. “Younger, digital-native investors need to plan for longer life expectancies and an extended investment horizon, and they recognize that this requires careful strategy rather than a trading mindset. Moreover, these digital natives face information overload, which can lead to investment paralysis or poor decision-making, particularly in markets that often seem to behave illogically. They are actively seeking guidance to avoid making serious financial mistakes. Catering to this need is therefore pivotal for the industry in Asia,” the report points out.

PSYCHOLOGY OF INVESTORS

The report argues that many of the region’s affluent investors are multi-banked, but many also feel they intend to consolidate their investments with a smaller number of providers or even at a single institution. And, the gains could be significant for those banks that can best optimize their client offering and become the recipients of this consolidation. For this, though, they need to cater to the key advisory group of customers.

The report maintains that the wealth managers who succeed will be those that build next-generation advisory into their proposition.

“These transformations will empower human RMs with the best technology and channels, allowing them to reach many more clients and gear their service to the expectations of Asia’s rapidly growing affluent class. Enabling RMs to transmit relevant, personalized advice and insights to customers across a range of wealth segments and interests is a technological challenge that can be overcome. But firms are being held back by a resistance to change, the limited availability of the right talent, and improvised methods of transformation management,” the report cautions.

AUM TO DOUBLE

The report also mentions that wealth management firms expect assets under management (AUM) to nearly double from 2021 to 2025 and revenue to grow about 60%. However, realizing the wealth managers’ growth plans will be extremely challenging and achieving those ambitious growth targets will be difficult, given the need to retain and acquire clients who are increasingly looking to switch providers, and the need to increase massively the hiring of RMs at a time of industry-wide talent shortages.

While there are advisory propositions in the market, most firms, says the report, are struggling to deliver true next-generation advisory.

4 FACTORS

The report lists 4 major factors holding firms back from delivering true next-generation advice: internal capabilities (such as effective segmentation as well as quality data and tools), sales processes and behaviors (such as moving from sales-based advisory to advisory-based sales), talent and change-resistance and sub-optimal transformation management capabilities.

The report also observes that winning in advisory means winning overall, explaining that delivering a satisfactory proposition to the advisory persona in Asia has a significant bearing on retaining clients and being considered their primary wealth management firm.

_________________________

Read More-