By P. Krishnan, CEO & CIO, Spark Asia Impact

Something unusual played out in the US financial markets when the US President shocked the world by deploying tariffs as a weapon of mass destruction of trade. Equity markets tanked, as expected. Bond prices went down and so did the USD, which defied all logic. A risk aversion towards equities signifies a flight to the perceived safety of US bonds. Bonds and USD should have strengthened. Even the Treasury Secretary of the US anticipated the same. The market, however, had other plans. Welcome to the world of chaos.

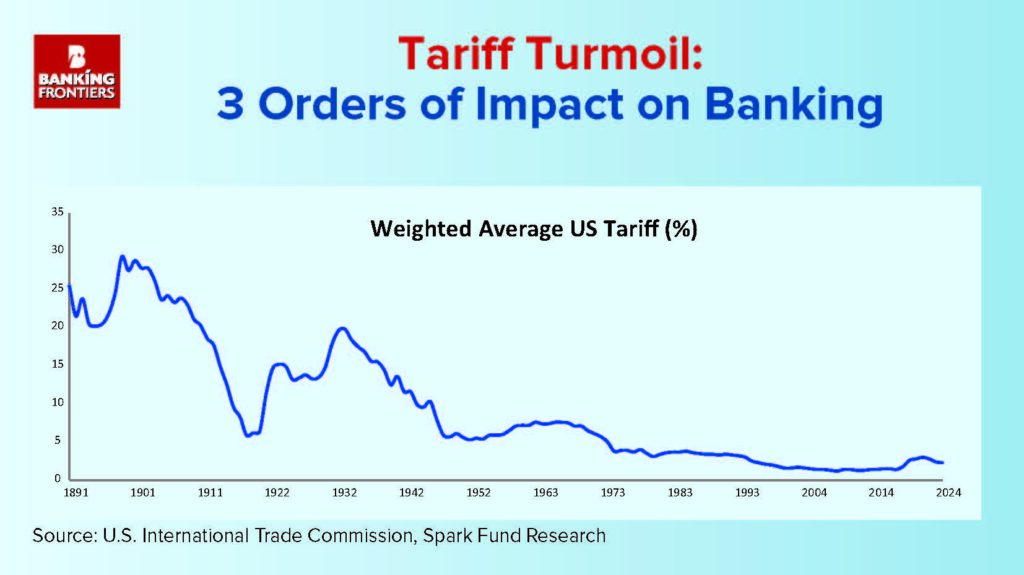

What transpired signalled a centennial shift in US priorities. US, which spearheaded the liberal multilateral trading system, is abandoning the same. This comes amidst uninspiring global growth and debt dynamics. It is quite probable that the US will unwind a lot of the unilateral levies that it imposed on its own imports. But something has changed for good. The behavior of bonds and USD that we saw in April exemplifies faltering faith in US as a safe haven. Consequences will follow.

1st order impact on Indian financial market

Indian banking sector is largely insulated from the tariff shock. It is a closed system of domestic savings and lending. Banks may be affected by potential stress on loans emanating from impact on exporters. If tariffs imposed on competitors in trade are similar or higher, the relative impact is muted or even positive. In garments and electronics, the positive impact is already visible as new arterial routes emerge in the supply chain. India is in the leaderboard of nations that could close out a trade deal with the US. So far, so good.

2nd Order Impact – Capital flows

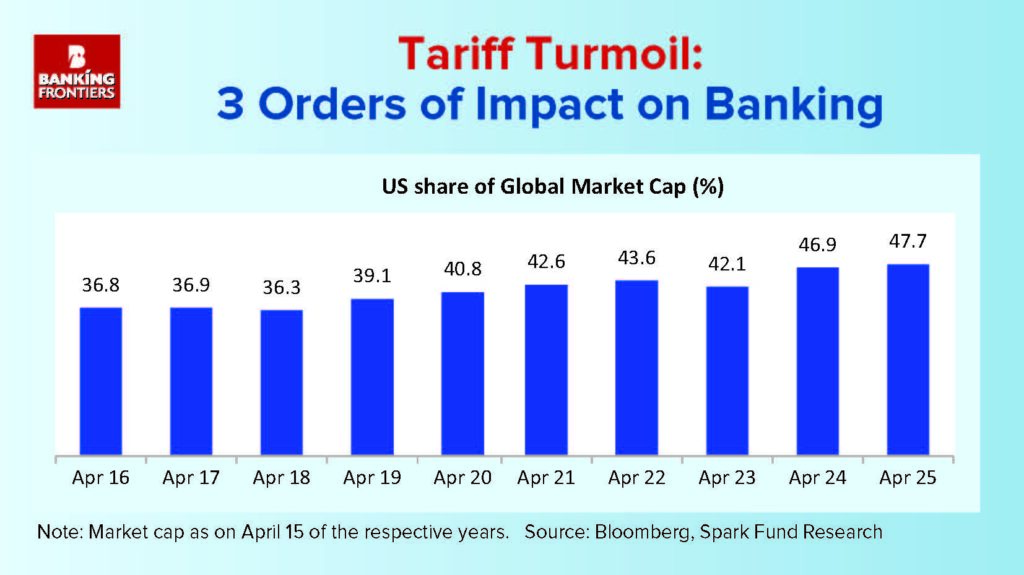

The quickest transmission on flows is through FPIs. Flows have actually turned positive after the tariff tantrums. It looks clear that one far-reaching impact for the US is on itself. While there is risk of inflation and recession, the long-term hit is on investor confidence. The world has been funding US deficits for decades. The status of USD as the world’s reserve currency and the magnetic effect of the US as the economic pivot have driven US exceptionalism. The US debt is at an alarming $36 trillion or about 120% of GDP. The reaction in the bond market and the USD suggests a tectonic shift. While there is no immediate threat to the USD as the preeminent global currency, capital flows to the US are at risk.

The US equity markets have been cornering a disproportionate share of capital flows, and this is evident in the graph below. Even a moderate realignment in capital flows can benefit smaller markets like India. Higher growth, its large domestic market and utility as a potential hub in emergent supply chains will drive capital flows into India. Indian banking system is well-placed here.

3rd Order Impact – Policy reforms & regulations

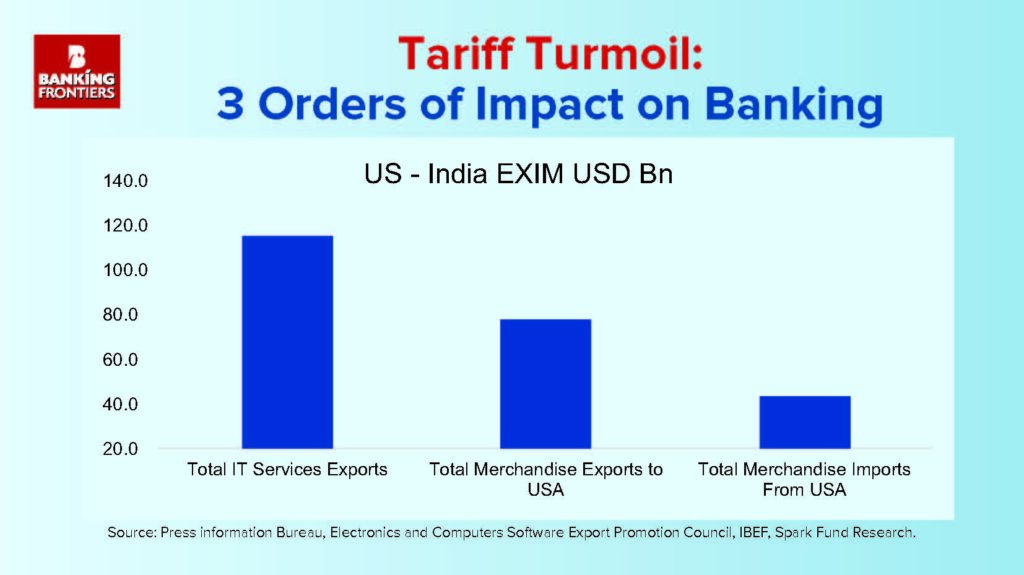

This is where there could be potential impact for banks. This may take time to play out. Look at the trade deficit with the US.

India has been running a modest trade surplus with US and the number skyrockets when tradable services are included. US cannot export goods to India and correct the trade imbalance given the low Indian per capita income. It is in owning a slice of India’s future that the US will eventually get to and exert pressure. Banking and retail are two large sectors where India does not allow foreign ownership in any meaningful manner.

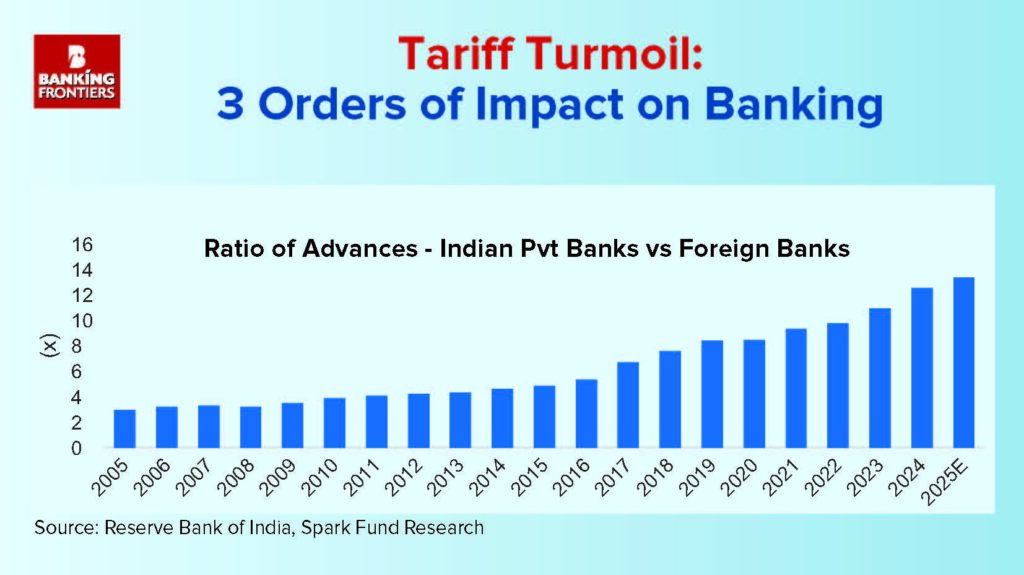

Before the global financial crisis in 2008, there was some talk on opening up of Indian banking sector. This died down when global banks were engulfed in the GFC. Indian private banks have grown to be way bigger than the foreign banks in India since then.

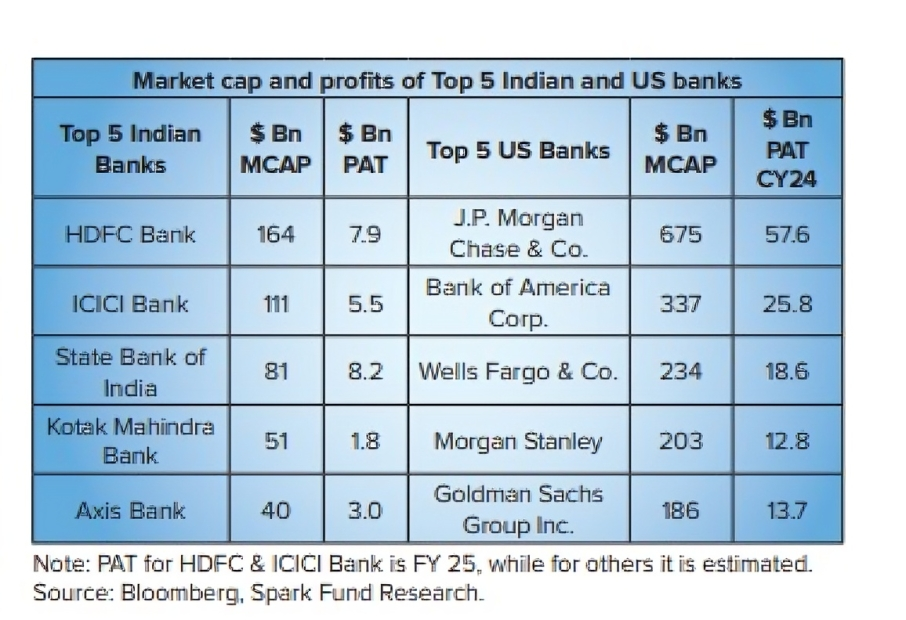

While US banks are much larger in size, Indian banks are not pushovers anymore. There is of course the challenge of managing the volatility of foreign capital flows. However, allowing ownership and control is not the same as opening regulatory floodgates for foreign savings into India. Premature as it is, the next phase of evolution in Indian banking will be to prepare for global competition. Sectors such as insurance, asset management and shadow banks are facing it. Global capital comes with best practices and consumers stand to benefit. Moreover, it expands markets and employment. The upheaval initiated by the Trump administration may prove to be a policy driver. Market cap and profits of Top 5 Indian and US banks

Welcome to the world of chaotic beginnings into unchartered territory.

P Krishnan is the MD & CIO of Spark Asia Impact Managers Pvt Ltd, which manages about Rs 11.5 billion of equity funds. He has 35 years of investment experience across India and emerging Asia. His stint spans Indian mutual fund industry/portfolio management industry as well as nearly 2 decades with the one of the largest Scandinavian fund management houses.