A recent study by CRISIL shows that affordable housing finance constitutes 34% of the overall housing finance market:

The overall size of the affordable housing finance market in terms of loan outstanding was Rs10.6 trillion as of 9MFY24, which constituted around 34% of the overall housing finance market, reveals a recent study by CRISIL. A noteworthy feature is that public sector banks account for ~46% in in this segment. On the other hand, housing finance companies’ share was 27% (Outstanding loans of Rs2.8 trillion) followed by private banks at 24% (outstanding loans of Rs2.5 trillion).

As per government and RBI stipulations, housing loans with a ticket size of less than Rs2.5 million are considered as affordable housing loans.

SUBDUED GROWTH

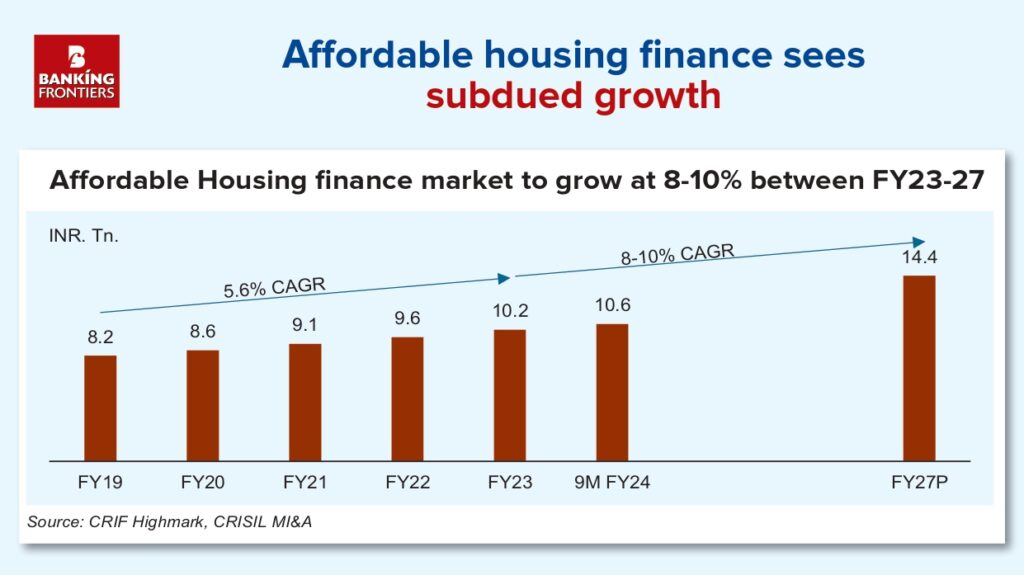

The study, carried out for Bajaj Housing Finance, however, indicated that between fiscals 2019 and FY23, the growth in the affordable housing loans had remained subdued, with the segment having witnessed a CAGR of 5.6% as compared to overall housing loans, which has grown by ~12.6%. The study said this can be primarily attributed to a slowdown in economic activity, funding challenges due to NBFC crisis and the pandemic. It also noted that factors like adoption of hybrid work model and work from home, as well as the rising propensity to spend and rising standard of living due to rising incomes of individuals contributed to an increase in demand for bigger residential homes.

“As a result, the sale in affordable housing took a beating whereas high-end and mid-segment housing gained the maximum in the last couple of years. In fiscal 2021, with the onset of pandemic in the first half of the fiscal, there has been a disproportionate impact on the segment’s EWS and LIG customers vis-a-vis the overall segment that caters to salaried individuals, whose incomes have been relatively stable. However, with faster-than-expected recovery in the second half because of the central and state government measures, proactive measures by RBI and tax sops with low interest rates led to growth in the affordable housing segment,” said the report.

STIMULI FROM GOVT

The report is concerned about the tepid pace of the growth of this segment, but it is optimistic about the future growth on account of the government’s increased focus on housing and incentives being given by some state governments like lowering stamp duties and rising demand for affordable homes as consumers increasingly work out of tier 3/4 cities in a post covid world.

The study says the expectation is that the industry would pick up steam gradually and the affordable housing segment could touch Rs14.4 trillion by FY27, translating into an 8-10% CAGR between FY23-27.

The study said as of 9M FY24 Maharashtra accounted for the highest share in the affordable housing finance segment, ~18% share, followed by Gujarat, Tamil Nadu, and Uttar Pradesh accounting at ~11%, ~9% and ~7% respectively.

ADVANTAGE HFC

The study points out that the share of housing finance companies rose in 9MFY24 to 27% from 26% in FY22, mainly because of creation of niches in catering to particular categories of customers, strong understanding of customer segment, excellent customer service and diverse channels of business sourcing and ability to assess collateral in smaller towns. It said these factors could help them maintain market share in the future as banks have become risk averse and are focusing on high ticket customers with good credit profiles.

Housing finance companies operating in the affordable housing finance segment have also seen a rise in their margins from FY20-23, with NIMs rising from 3.5% in FY20 to 5.0% in FY23, said the report, adding during the same period credit costs for the companies also witnessed a fall from 0.9% in FY20 to 0.4% in FY23.

The study listed some of the government initiatives in the affordable housing finance segment:

- Pradhan Mantri Aawas Yojana – Urban, which aims to fill the supply-demand gap in the housing sector.

- Pradhan Mantri Aawas Yojana – Grameen, which is for the rural population who do not have their own houses. It provides financial assistance and interest rate subsidy.

- Relaxation of ECB guidelines, including relaxed external commercial borrowing guidelines that enable easier access to overseas funds and stimulate the sector.

- Reduction in the GST rate for affordable housing projects.

- Permission to withdraw 90% of employees’ provident fund (EPF) corpus

The study also highlighted the fact that regulatory authority of HFCs has been shifted from NHB to RBI, which has led to more streamlined regulations and better risk management framework for HFCs.

The study mentions 4Cs that can be adopted by HFCs to succeed in affordable housing finance segment – Clear understanding of micro markets, Customer risk and Collateral risk assessment and Collection efficiency.

Recent Articles:

Shift Employees to VPN; Shift Data to Cloud