Paytm Money has released its Annual Report for 2021. Here are the key findings:

India’s retail participation in equity markets remained strong in 2021. It was once again led by the millennial investors with nearly 80% of Paytm Money investors under the age of 35. Diversification and discipline were evident from their investment patterns. Millennial investors also took an increased interest in long-term tax-saving products indicating a mature approach towards investing. They also continued to be price sensitive as they kept an eye out for savings on trading brokerage and commissions.

India’s retail participation in equity markets remained strong in 2021. It was once again led by the millennial investors with nearly 80% of Paytm Money investors under the age of 35. Diversification and discipline were evident from their investment patterns. Millennial investors also took an increased interest in long-term tax-saving products indicating a mature approach towards investing. They also continued to be price sensitive as they kept an eye out for savings on trading brokerage and commissions.

Equity AuM triples

Within the equity segment, the average assets under management per user on the platform tripled in 2021. Average number of stocks traded per user also went up from 12 to 30 indicating higher diversification. Proportion of millennials buying ETFs in 2021 also saw a sharp rise with the average number of ETFs within the portfolio increasing by 50%.

went up from 12 to 30 indicating higher diversification. Proportion of millennials buying ETFs in 2021 also saw a sharp rise with the average number of ETFs within the portfolio increasing by 50%.

Intraday trading becomes popular

Trading activity by millennials was high in 2021. Proportion of millennial users trading intraday jumped from 39% in 2020 to 50% in 2021 while the F&O segment witnessed 327 trades on average per user. 70% of millennial users applied for IPOs with 8 applications on average per user.

millennial users trading intraday jumped from 39% in 2020 to 50% in 2021 while the F&O segment witnessed 327 trades on average per user. 70% of millennial users applied for IPOs with 8 applications on average per user.

Higher risk appetite

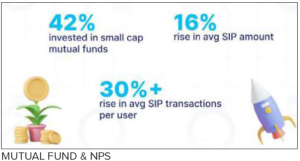

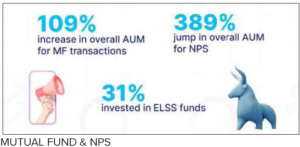

Passive investing continued to be favoured by millennials as the average investment amount per user in mutual funds saw a 35% rise. Overall assets under management for this segment more than doubled last year, growing by 109%. There was however, an increased preference for small cap funds indicating higher risk appetite. 42% of millennials invested in small-cap funds in 2021 up from 31% in 2020. Among the 10 most traded mutual funds on Paytm Money, 3 belonged to the small-cap category while 1 belonged to the mid-cap category.

Tax Saving

Mutual fund SIP trends show an increased discipline among millennial investors. In 2021, there was a 30% rise in the average number of SIPs per user with the average SIP value increasing by 16%. A similar preference was also seen for ELSS funds with average investment in these funds rising by 23%. Proportion of millennials investing in ELSS funds also increased from 26% in 2020 to 31%. Given these funds are tax saving instruments with a 3-year lock-in period, the above numbers point towards a mature approach towards investing.

Thinking long-term

Also worth noting that the number of millennials investing in the National Pension Scheme more than doubled in 2021. Overall assets under management for NPS also grew by 389% with investments made through Paytm Money platform. NPS is an extremely long-term investment with tax optimization benefits and a preference for such investments among millennials indicates their long-term commitment towards investing.

Increased Learning

Users also showed an inclination to better understand financial markets. More than 55,000 users watched at least one video on Paytm’s Wealth Community with the total amount of time watched at 2880 hours. Users were particularly interested in IPO analysis.

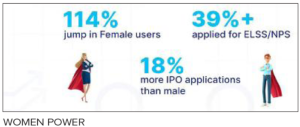

Female power grows

Another interesting trend was that the number of female invested users more than doubled over the past year growing by 114% and a higher percentage of female investors were profitable as compared to their male counterparts.