Qube Money is the new way one can use the services of the bank with the value add of having one’s finances managed well:

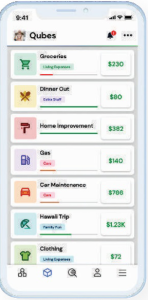

Qube Money is a fintech startup in the US with an app at its core that combines the functionalities of a bank and a controlling system on spending and avoiding debt. It employs the concept of an envelope budgeting system where one can cash out his income and separate the money into different budget categories. Some money can be earmarked for long-term envelopes like buying a house or a vacation, and other money for fast-spending envelopes like medicare, educational expenses, or groceries or restaurants. The unique thing about the app is that it combines a digital cash envelope budgeting method with a full banking suite. Budgets are digitized as ‘Qubes’ and consumers can set limits under different Qube budgets, like for example buying groceries or procuring clothes or entertainment. There is a physical Qube Money debit card that gives customers access to their pre-budgeted Qube funds.

Qube Money is a fintech startup in the US with an app at its core that combines the functionalities of a bank and a controlling system on spending and avoiding debt. It employs the concept of an envelope budgeting system where one can cash out his income and separate the money into different budget categories. Some money can be earmarked for long-term envelopes like buying a house or a vacation, and other money for fast-spending envelopes like medicare, educational expenses, or groceries or restaurants. The unique thing about the app is that it combines a digital cash envelope budgeting method with a full banking suite. Budgets are digitized as ‘Qubes’ and consumers can set limits under different Qube budgets, like for example buying groceries or procuring clothes or entertainment. There is a physical Qube Money debit card that gives customers access to their pre-budgeted Qube funds.

FREEING FROM TYRANNY OF MONEY

Qube Money claims its mission is to ‘free people from the tyranny of money by breaking the paycheck-to-paycheck cycle and eliminating personal debt’. At present it is available to qualifying customers in the US. Qube’s premise is simple:iIt turns the envelope budgeting method digital and layers it on top of the consumer’s bank account for a seamless digital budgeting.

Located in Pleasant Grove, Utah, the US, Qube Money was founded by Ryan Clark, who was once in the real estate market, later became a mortgage broker and finally took up the job of teaching novices how to spend money wisely. The platform he created combining the banking system and the budgeting system, has the power to be a transformative tool for spenders. Users can deposit money into an FDIC-insured Qube Account, they can design a plan to allocate funds among different digital ‘Qubes’ either pre-generated categories or one’s own created. The transactions are managed through the Qube debit card.

As a default, the Qube card has zero balance. If one tries to swipe the card without allocating a transaction to an envelope/Qube, the transaction will be denied. Whenever one wants to spend money, he opens the Qube Money app on the mobile phone, select the Qube where the money will be spent and funds will immediately be made available through the Qube debit card. As soon as the transaction goes through, it is recorded in the relevant Qube and any remaining funds are transferred back into the Qube. The balance on the debit card is reverted to zero.

Qube works for both online and in-person transactions.

FEE FOR THE FACILITY

Qube Money has a free tier which limits users to 10 cash envelopes and a single debit card. The free tier does not offer budget automation so one needs to reset the Qubes each pay period. There is a Premium plan which offers unlimited Qubes, recurring transfers, joint accounts and partner notifications. There is also a Family plan for individuals and couples with children, which offers up to 10 kid debit cards, parent view, parent permission, chore trackers, in app money requests. There is a charge for the Premium plan and the Family plan.

FUNDING THE ACCOUNT

A Qube account can be funded through various ways. One can link it to an external bank account. If the bank is in Plaid’s network (a data network that powers the fintech tools), one can connect it directly to the Qube account to instantly transfer up to $250 at a time. In Qube Money, one can also set up direct deposit with the employer, and have the paycheck deposited into the Qube account. Besides, person-to-person money transfers are also possible. One facility Qube Money provides is that one can use any ATM to withdraw cash from the Qube account, and it will reimburse ATM fees up to $10 per month.

Qube Money accounts are backed by its partner bank, Choice Fin, a subsidiary of Choice Financial Group.

Qube Money has competition, the chief among them being the neobank Chime, which also provides budgeting facility through its app, along with savings and spending features. There are also other budgeting tools like YNAB and EveryDollar, which offer digital cash envelope style budgeting, but these apps are not tied to one’s actual spending. With Qube, there is a digital bank account that is tied to one’s spending categories, making one’s budget and one’s spending integrated seamlessly. However, Qube accounts for money in one’s Qube account and budget categories related to the Qubes. It does not show one’s savings accounts, other checking accounts, credit card expenses or investment accounts. This is a major disadvantage. Qube Money is, however, developing a facility called ‘Tracking Qubes’ that would allow one to track and categorize expenses not made with the Qube account but through other bank accounts, credit cards, etc.

Ryan Clark, Qube Money’s founder, believes Qube is the beginning of Banking 2.0. He maintains that the power and control that people once enjoyed with cash have been eroded over time with digital currencies. Qube restores these controls and with them the ability for people to gain financial freedom.