While in pre-covid days, the millennials had a sense of bravado about their health, that has changed post the pandemic:

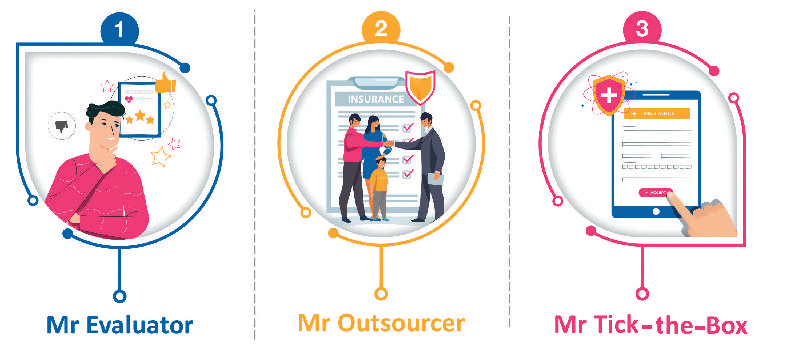

A recent study by Edelweiss General Insurance has highlighted 3 interesting and distinct customer mindsets within the millennials – Mr Evaluator, Mr Outsourcer and Mr Tick-the- Box while outlining how covid has led to heightened awareness about the need for buying health insurance. The study, however, cautions that there still seems to be resistance when it comes to actually buying a health policy and that there is a huge gap between realizing the need and the actual action of buying one.

The study, titled ‘A finger on the pulse’, analyzes the financial, emotional and psychological factors that encourage millennials to buy health insurance and also maps the barriers that stop them from buying.

3 CATEGORIES OF BUYERS

The study describes the 3 categories of insurance buyers stating Mr Evaluator wants only the best policy, and hence will spend substantial time and effort in thoroughly researching and evaluating available options before making a choice. For him, the agent is a source of information, not the expert he relies on. He rather reaches out to trusted sources offline and online to ensure that his choice of policy and brand are correct. On the contrary, Mr Outsourcer understands the value of health insurance and hence needs a policy that is adequate enough to cover him and his family. He, however, relies on an agent and consults him before making a choice. For Mr Tick the Box ease and convenience matters and hence online purchase is his go to route. Generally, he looks up insurer and aggregator websites to make a choice. He is premium sensitive and works within a budget.

Explaining the findings, Shanai Ghosh, Executive Director and CEO, Edelweiss General Insurance, said millennials will play a big role in improving India’s health insurance penetration. The insights drawn from the research has only helped reiterate the belief that it is important to know and understand the customer, and offer them simple, easy, and convenient solutions that encourages them to one, trust the category and two, invest in it, she added.

AGENT-DEPENDENCE

The study maintains that overall, while the online space is growing, India is made up of many kinds of people, many of whom are agent-dependent. And agents play a crucial role in Introducing the brand, creating familiarity for the brand and informing and influencing.

The study says there are several barriers still existing in buying health insurance in India. Expense is a factor, but it is not just the fact that health premiums are seen as high. It is also that Catch-22 feeling – a person needs it, but if he does not end up using it, it would end up as a waste. Then there is the cost factor. Cost actually puts a lot of people off. Then, they really do not understand the details, and come across loads of fake news and false beliefs. Lastly, the young never believed that anything bad could happen to them and for insurers this attitude used to be a tough nut to crack. However, the pandemic has softened it, says the report.

SUMMING UP

The study comes out with the following conclusions:

- Consumers are high on features, low on brand loyalty and sensitive to price

- With the pandemic and the increase in lifestyle diseases, there has been a paradigm shift in thinking – now, people actually think about insurance

- Digital searching and buying has caught on fast, and will only accelerate

- The 25+ simply want cover, the 30+ want extra cover, preferably cashless, not reimbursement

- Brands need to have unique products, a big network of hospitals and service that customers can totally take for granted

- Fewer exclusions, more coverage – a win-win for customers

- Products are being compared online by customers, and simplification is the key