Vibrant and resilient cooperative credit institutions in Gujarat have given sizable Atmanirbhar loans in 5 months of the covid pandemic to distressed borrowers:

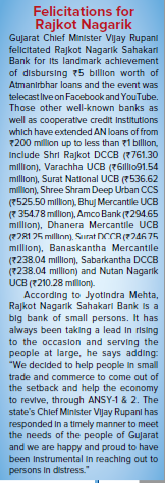

Jyotindra Mehta proclaims that Rajkot Nagarik Sahakari Bank is a ‘big bank of small

Gujarat State Cooperative Bank, all urban cooperative banks (including those registered under the Multi-state Cooperative Societies Act), district central cooperative banks, and cooperative credit societies and working in the state of Gujarat, have implemented the scheme of providing loans up to Rs250,000 on soft terms to the small traders, retailers, job-workers, self-employed persons, workers and middle-class persons in the last 5 months of the current financial year.

On the lines of Atmanirbhar Bharat Abhiyaan, Gujarat Chief Minister Vijay Rupani had launched ‘Atmanirbhar Gujarat Sahay Yojana’ for the benefit of over 1 million lockdown-hit small traders, hawkers, skilled workers, and a cross-section of people falling under the lower-middle-income group.

WHOLEHEARTED SUPPORT

There are several important aspects of the Atmanirbhar Gujarat Sahay Yojana. Jyotindra Mehta, President, UCB Federation, Gujarat, explains: “After consulting leaders of various types of banks and representatives of cooperative forums, the state government has created the scheme to help grocery shop owners, vegetable vendors, labourers, autorickshaw drivers and poor people whose regular flow of income has been disturbed because of the continuous covid led lockdown. The state government has sanctioned an unlimited amount for the project, which has been implemented by all the cooperative institutions of the state wholeheartedly. All the borrowers are entitled to a 6-month moratorium during which they are also not required to pay any interest.”

Dr. Jayna Bhakta claims that Sarvodaya Bank did a perfect handholding for MSMEs and small shopkeeper

Jayna Bhakta, Director, (formerly MD), Sarvodaya Urban Cooperative Bank,  says during the lockdown all businesses were shut, the MSME sector was at a standstill. Gradually, when unlocking started, businessmen were at a loss to figure out how to repay the loans they had availed earlier. “Startups were struggling to find a way out because of erosion of capital. The whole sector needed a push and the Gujarat government was deliberating with some of us, bankers, on how to be helpful to one and all. This scheme of subsidy was suggested to the government and Atmanirbhar Sahay Yojana-1 took shape. But, as the amount of Rs100,000 was found to be not sufficient for all and sundry, we all cooperative bankers again represented to the government and as a result, the second scheme, ANSY-2, with a loan amount up to Rs250,000 was introduced,” says she.

says during the lockdown all businesses were shut, the MSME sector was at a standstill. Gradually, when unlocking started, businessmen were at a loss to figure out how to repay the loans they had availed earlier. “Startups were struggling to find a way out because of erosion of capital. The whole sector needed a push and the Gujarat government was deliberating with some of us, bankers, on how to be helpful to one and all. This scheme of subsidy was suggested to the government and Atmanirbhar Sahay Yojana-1 took shape. But, as the amount of Rs100,000 was found to be not sufficient for all and sundry, we all cooperative bankers again represented to the government and as a result, the second scheme, ANSY-2, with a loan amount up to Rs250,000 was introduced,” says she.

HEAVILY SUBSIDISED

Around 2.5 lakh people have been given advances of Rs100,000 each from banks at 8% interest per annum without any collateral security. The Gujarat Government will pay a 6% subsidy to the banks, so the net burden on the borrowers is just 2%. ANSY-1 & 2 were in operation from 6 June to 15 November 2020. For loans up to Rs100,000, the borrower pays only 6% during the tenure and the government will clear the remaining 21%. For loans of more than Rs100,000 and below Rs250,000, the borrowers need to pay only 12% interest during the tenure and the government will pay the subsidy.

218 UCB, 18 DCCB IN ACTION

There are half a dozen cooperative banks, which have provided Atmanirbhar loans above Rs1 billion. At the top is Rajkot Nagarik Sahakari Bank, which has sanctioned 38,825 loans, amounting to Rs5.24 billion, and has already disbursed Rs4.95 billion to 37,043 borrowers.

Jyotindra Mehta says there are 578 cooperative credit institutions in Gujarat, including 218 UCBs and 18 DCCBs, which have collectively given 208,523 Atmanirbhar loans worth Rs25.34 billion to the neediest persons of the society during the covid pandemic.

Dr. Jayna Bhakta says Sarvodaya Bank had arranged for all the customers to get the forms from all the branches of the bank and the managers were given powers for disbursement. There has been a perfect handholding by the bank for MSME units as well as startups and small shopkeepers, she says and explains that there were various types of borrowers like vegetable vendors and pan shop owners for loans up to Rs100,000. MSME unitholders and yearn merchants were entitled to loans up to Rs250,000, she adds.

SURAT, SARVODAYA BANK, SHINE

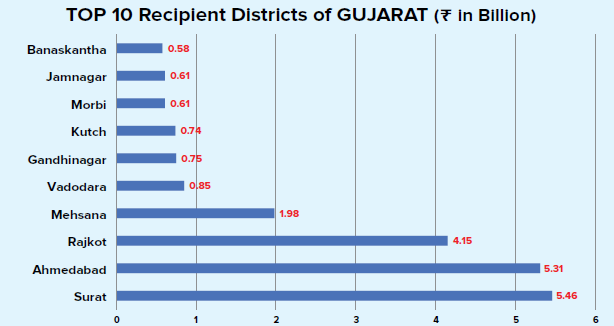

Of the 33 districts in the state, Surat district topped the list with loans worth Rs5.46 billion getting disbursed by all the cooperative credit institutions, followed by Ahmedabad (Rs5.30 billion), Rajkot (Rs4.15 billion), and Mehsana (Rs1.97 billion). Institutions in other districts individually disbursed less than Rs1billion.

Sarvodaya Bank, Surat, has extended total loans of Rs462.55 million. Dr. Jayna Bhakta gives details: “Loans worth Rs277.59 million were disbursed under ANSY-2 and loans worth Rs184.96 million under ANSY-1. There are 12 loans amounting to Rs1.55 million pending disbursal against the total of 3083 loans sanctioned. The maximum lending of Rs101.81 million has been done by the branch at our head office, followed by our branches at Ved Road (Rs93.29 million), Ring Road (Rs74.62 million), and Athwa lines (Rs58.47 million). Several cooperative banks in Surat have done a good job in this regard.”

Top 11 CCS’ Helping Hand

Among the top 10 cooperative credit societies, which have extended loans of Rs10 million to Rs60 million are Kherva Coop Credit & Consumers Society (Rs55.53 million), Shree Aradhana Urban CCS (Rs54.30 million), Sarvoday CCS (Rs32.87 million), Kansa Peoples CCS (Rs32.17 million), Shree Satyay Thrift and CCS (Rs30.70 million), Vijapur Market Yard CCS and Vardhaman Nagarik Sahakari Sharafi Mandali (Rs30.50 million each), Vasundhara Nagarik CCS (Rs26.82 million), Youth Savings and CCS (Rs23.29 million) and Bhagyoday Urban CCS (Rs24.92 million).