The State of the Financial Crime 2022 report highlights how business owners and fraud specialists look at the behavior and operational methods of fraudsters following covid:

The State of the Financial Crime 2022, a report brought out by UK-based regtech company ComplyAdvantage, predicts that criminals will continue to adapt and exploit opportunities to grow and evolve as the world continues to contend with covid, and says dominant themes of the ‘new reality’ in 2022 will include disrupted supply chains, the implosion of fraud, widespread ransomware attacks and continual attacks on the emerging digital payments ecosystem. The report advises that firms should review their business risk assessments to identify emerging threats and update policies and processes to help prevent and detect financial crime in their organizations.

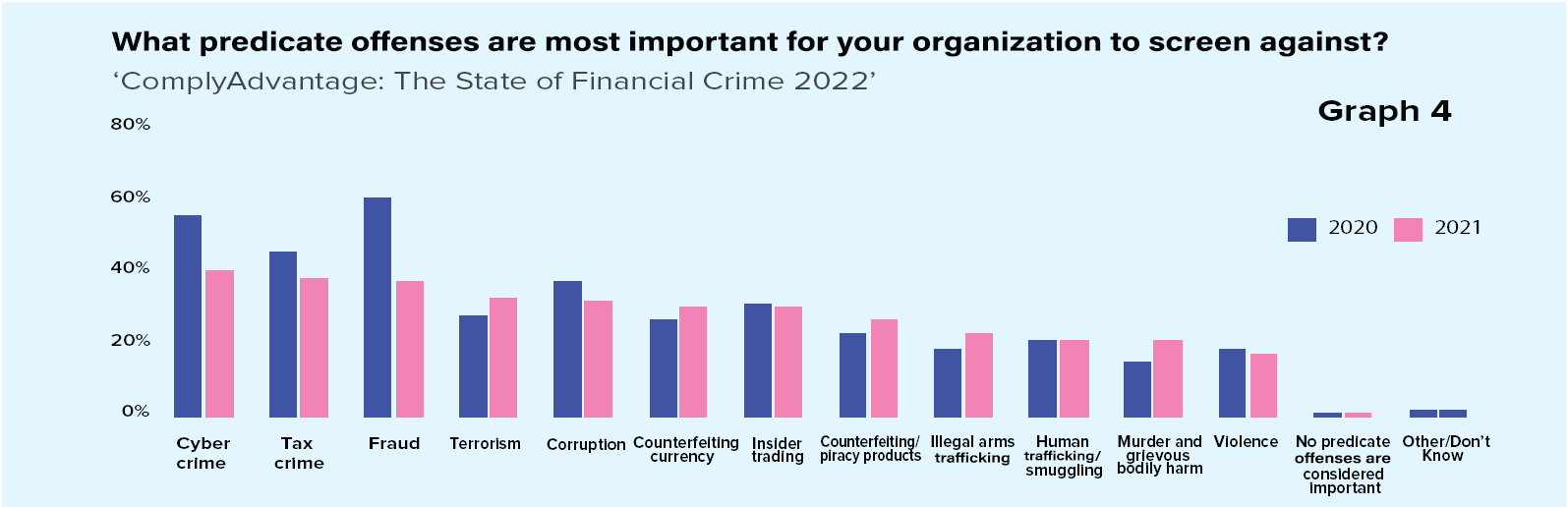

ComplyAdvantage had interviewed 800 C-suite and senior compliance decision-makers in domains such as enterprise banking, investments, crypto, insurance and fintech across North America, Europe and Asia-Pacific in late 2021 and their responses form the basis of findings and recommendations in the report. The report says whereas 2021 saw a focus on adaptation through a global pivot to remote working and major stimulus programs, 2022 will be the year of adjustment. It says: “One example of this in the survey relates to predicate offenses. When asked for the top predicate offenses firms are screening against in 2020, 61% cited fraud amid widespread reporting about fraudulent activity related to covid relief funds. By 2021, the percentage of respondents citing fraud had dropped dramatically to 37%. Instead, cybercrime was listed as the most important predicate offense firms are screening against, followed by tax crime. As these figures suggest, challenges outside of the pandemic are emerging. Following key sessions at COP26, as well as the G7 and G20 summits, it’s likely environmental crime will be a major theme this year…. The regulation of crypto firms and virtual asset service providers (VASPs) will remain high on the agenda for 2022.”

SUPPLY CHAIN SHOCKS

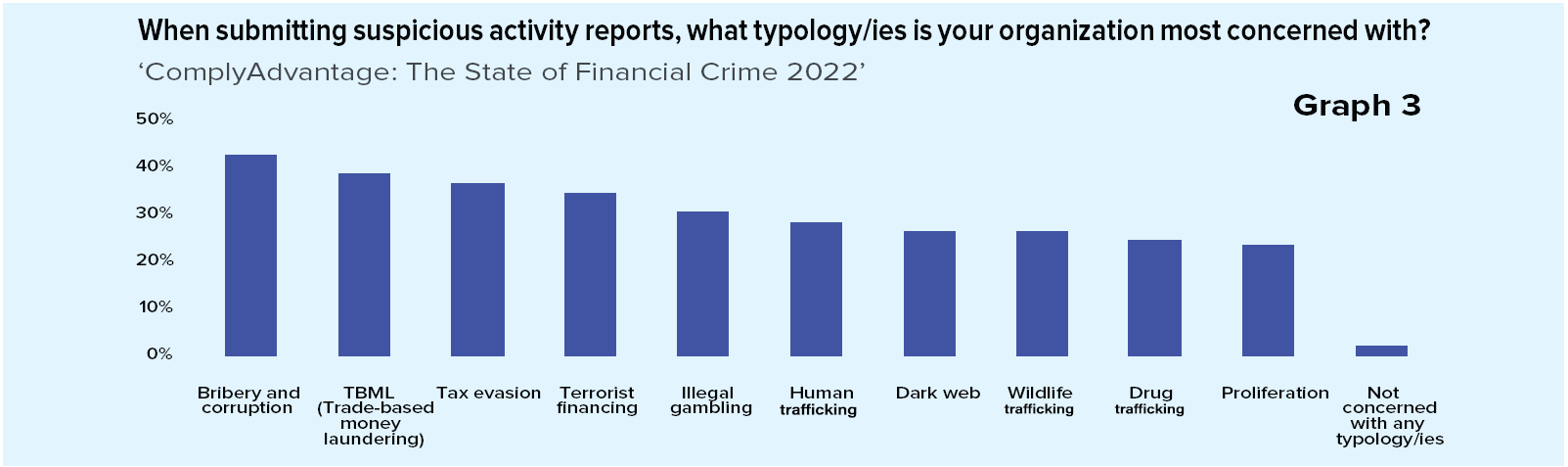

The report says since one of the biggest impacts of supply chain shocks has been on the cost of shipping goods, criminals are looking for more opportunities to enter the shipping market and operate a number of trade-based money laundering schemes, including the over- or undervaluation of goods, the over- or under-shipment of goods and false reporting on invoices, among others. The respondents to the survey, when asked about the typologies they are most concerned with, 38% cited trade-based money laundering, making it the second most common answer. Only bribery and corruption generated a higher response rate. (See Graph 3).

VIRTUAL, CRYPTO HELP CRIMINALS

Monetary assistance in the form of extended welfare programs, government-backed loans, and other measures in the aftermath of covid, says the report, has encouraged fraudsters to look at opportunities for exploitation. When asked about the predicate offenses they are screening against, the report says there was a notable drop in concern among the respondents in detecting fraud. The respondents pointed out that it is important to consider how new technologies can alter the red flags associated with traditional typologies. Virtual currencies, for instance, are becoming more mainstream, and the anonymity inherent in many cryptocurrency transactions makes it an attractive method to quickly and easily launder funds. “Therefore, it’s likely to become more common for money mules to convert funds from welfare or stimulus payments to a form of cryptocurrency as part of the laundering process. More generally, the continued digitization of the financial system will alter the fraud landscape. As digital wallets and contactless payments build further momentum, the digital payments market is expected to reach $10.7 trillion by 2025, up from an estimated $6.8 trillion in 2021. Reports of e-fraud and the misuse of electronic payment networks and e-money are expected to increase,” says the report. (See Graph 4).

When asked which areas of their AML programs firms are most focused on improving in 2022, the detection of politically exposed persons (PEPs) and relatives and close associates (RCAs) was top of mind for 48% of the respondents, followed by virtual asset risk monitoring (46%) and ultimate beneficial ownership (44%). (See Graph 6).

PAYING AML FINES

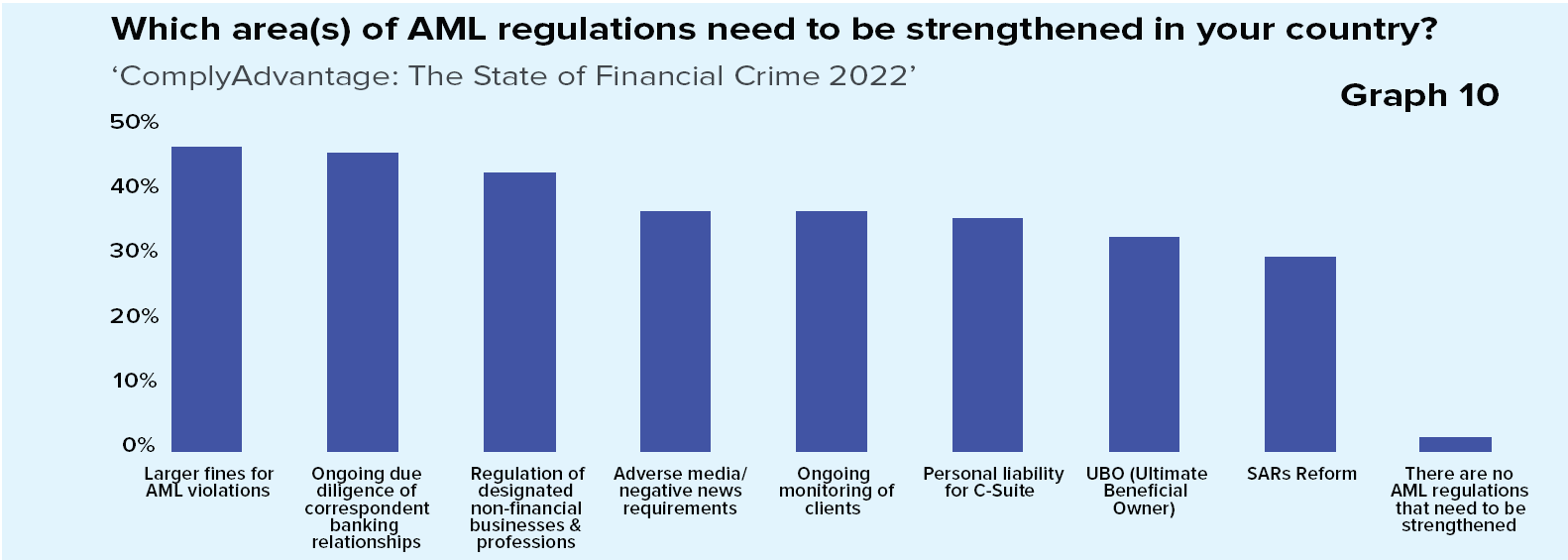

When it comes to AML fines, the report says globally there were notable increases in the number of firms saying they consider the risk of incurring a fine or violation (from 38% in 2020 to 52% in 2021) and in firms saying they choose to incur AML fines and make violations ‘all the time’ (from 25% up to 35%). “More than a third of firms surveyed globally now say they choose to incur AML fines and violations all the time. Despite this, only 2% of those surveyed felt no areas of AML regulation in their country needed to be strengthened. The main areas where organizations said there was room for improvement were: larger fines for violations (47%), ongoing due diligence of correspondent banking relationships (46%) and regulation of Designated Non-Financial Business and Professions (DNFBPs) (43%). (See graph 10)

The report says compliance teams in general felt the main areas in their departments they are looking to improve in 2022 are upgrading legacy technology systems (27%), managing and using data (26%) and how they work with third party suppliers (19%). When asked specifically where they will prioritize current and future investment in AML solutions, organizations pointed to dynamic risk scoring of customers and dynamic risk scoring of transactions (both 47%), followed by transaction monitoring (45%). The report mentions that at the core of many of these focus areas are AI and data analytics and the potential these innovations can offer to combine datasets and enable more real-time risk assessments.