Many of the measures in Finance Minister Nirmala Sitharaman’s Union Budget 2023-24 have garnered wholehearted support from bankers, BFSI entities, trade chambers, and industry associations.

Jeremy Zook, Director and Primary Sovereign analyst for India, Fitch Ratings: We believe India is well-placed to sustain higher rates of growth. The government’s continued emphasis on ramping up capex spending should provide a fillip to both near and medium-term growth. India’s fiscal deficit and government debt ratio are high relative to peer medians, but the government’s emphasis on reducing the deficit helps to stabilise the debt ratio over the medium term. The government aims for modest fiscal consolidation, while accommodating higher capex spend and changes to income tax slabs, largely by substantially reducing subsidies in the coming year. Over the next five years, we forecast India’s government debt-to-GDP ratio to stabilise at around 82%. Our robust growth outlook for India is a key factor supporting the stabilisation of the debt ratio in the absence of stronger deficit reduction.

Hetal Gandhi, Director-Research, CRISIL Market Intelligence & Analytics: The budget retains a sharp focus on manufacturing with an allocation of around Rs 11,000 crore towards incentives. Nearly 70% of these are linked to Production Linked Incentive (PLI) payouts and the balance towards payment of incentives to the semiconductor-linked ecosystem. The incentives are a meaningful push towards private capital expenditure as their allocations rise 2.2x from Rs 5,100 crore in fiscal 2023 revised estimate. However, these are lower than CRISIL’s initial estimates of Rs 24,000 crore for fiscal 2024 and indicate delays in implementation and invoice verification in the PLI scheme.

Ajay Kanwal, MD and CEO, Jana Small Finance Bank: Budget has consistency, growth orientation and balance. We see positive spots which interest us — agriculture, affordable housing and MSMEs. The rebate on personal tax will boost savings and consumption.

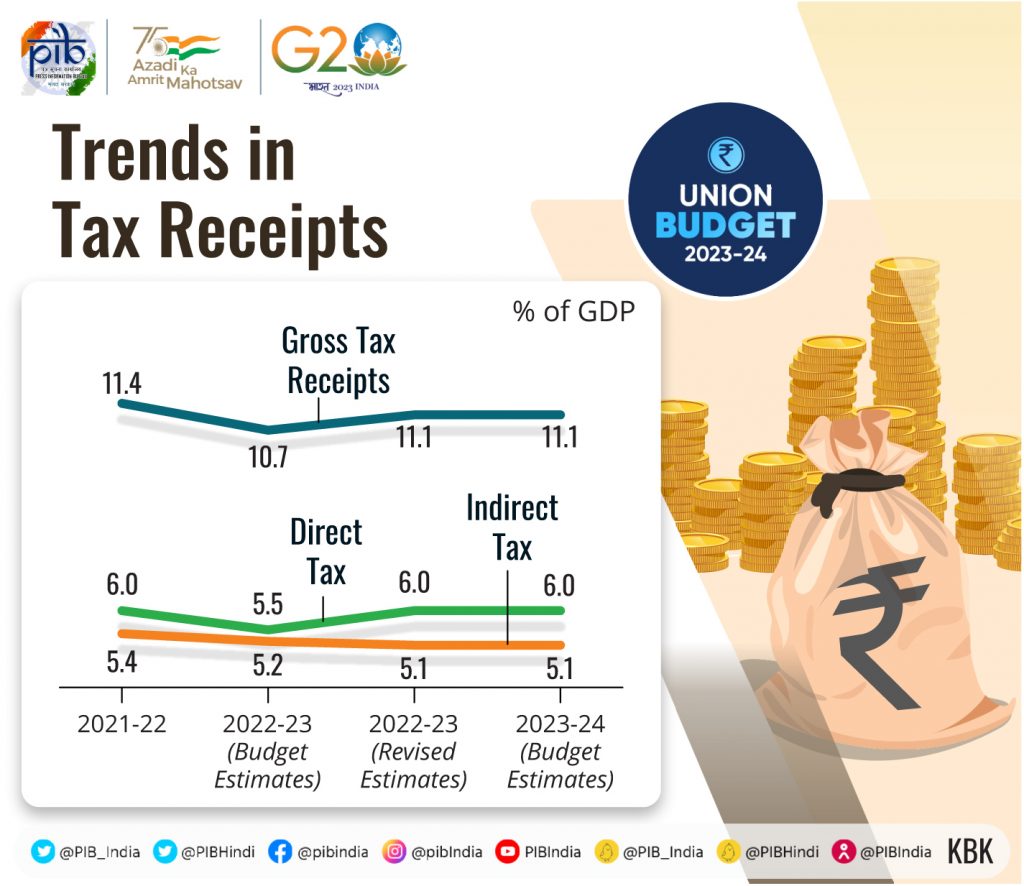

Economics team, Bank of Baroda: The budget is a manifestation of the ideology displayed in earlier budgets. The fiscal deficit ratio has been brought down to 5.9%. Net borrowing programme has been more or less at last year’s level. Focus has been on fine-tuning spending towards capital expenditure to create a multiplier effect on growth by crowding in private investment. Other estimates such as tax revenue collection in line with a slightly downward bias for GDP growth in FY24 seems feasible. Sector-wise, MSMEs have been the focus. Some relief has been given to households. Budget remains sanguine on disinvestment as a source of revenue.

Economics team, Bank of Baroda: The budget is a manifestation of the ideology displayed in earlier budgets. The fiscal deficit ratio has been brought down to 5.9%. Net borrowing programme has been more or less at last year’s level. Focus has been on fine-tuning spending towards capital expenditure to create a multiplier effect on growth by crowding in private investment. Other estimates such as tax revenue collection in line with a slightly downward bias for GDP growth in FY24 seems feasible. Sector-wise, MSMEs have been the focus. Some relief has been given to households. Budget remains sanguine on disinvestment as a source of revenue.

Dr Rupa Rege Nitsure, Group Chief Economist, L&T Financial Services: While the budget is market-friendly in terms of every asset class, it reflects good fiscal prudence on the back of subsidy rationalisation. As in the past three years, its underlying macroeconomic framework and revenue growth assumptions are conservative and realistic. A strong capex push by the government was the need of the hour. But its objective will be fulfilled if and only if the state governments as well as the private sector start raising their fixed investment spending.

Dinesh Khara, Chairman, SBI: The budget is growth accretive, fiscally prudent and consumption supportive. The huge emphasis on capital expenditure could be the perfect recipe for a private investment cycle that is already visible. Support for MSME and

agriculture will broad base credit growth. Reasonable government borrowing numbers will support lower interest rates and the move towards a clutter-free new tax regime will significantly spur consumption. Overall, the budget is forward-looking and will support an inclusive economy.

Gurpreet Sidana, Director & COO, Religare Broking: Overall, the FM has done a balancing act to tick most of the possible boxes without tinkering with the fiscal deficit. This budget has addressed the pain point of the economy — the rural space. There is a meaningful allocation of funds toward infrastructure, tourism, agriculture and green growth. Amendments in banking and the RBI Act to empower SEBI to protect and educate investors are important steps for the capital markets. The balancing act in indirect taxes and relief to salaried individuals by making the new tax regime more attractive is a positive step.

Sandeep Menon: MD & CEO, Vastu Housing Finance: The budget is largely focused on improving the social-economic conditions. Improved infrastructure in Tier 2 & 3 cities will lead to residential cluster development in the coming years. With enhanced capital expenditure by 33% and an increment in the outlay for PM Awas Yojana by 66% to over Rs 79,000 crore, the government has provided much-needed support to the affordable housing sector. Also, the relaxation in income tax slabs provides additional disposable income in the hands of the common man which can directly lead to growth in the affordable homes segment.

Tirthankar Patnaik, Chief Economist, National Stock Exchange of India: The use of technology in meeting policy objectives, reducing losses, and providing support to the weaker sections of society, through smart, tech-enabled means is visible throughout the budget. For the financial sector, the focus has been on inclusion, credit support to MSMEs, and simplifying and enabling governance in the GIFT-IFSC through a number of proposed amendments. The emphasis on reducing the compliance burden and unchanged capital gains tax regime are welcome.

Arun Raste, MD & CEO, NCDEX: From the rural perspective decentralization of warehousing capacity that the FM has talked about is a major decision and will play an important role in rationalizing the balance between demand and supply. NCDEX works with FPOs and small traders who use regulated warehouses and standard decentralized warehousing will help the country to eliminate wastage. However, this will have a greater impact if the WDRA regulation gets parliamentary approval soon, and eNWR replaces warehouse receipts. Promotion of millets and market-based instruments like derivatives on exchanges will ensure remunerative prices for farmers and more farmers will be encouraged to grow millets.

Hardika Shah, CEO and Aiswarya Ravi, CFO, Kinara Capital: Absolutely positive and energized with the budget. We applaud the budget extending the Credit Guarantee Fund Trust for CGTMSE Scheme with an infusion of Rs 9,000 crore, which will facilitate additional credit access of Rs 2 lakh crore for MSMEs. This will promote financial inclusion and employment growth in the sector. The announcement of 1% reduction in cost of credit bodes well for last-mile lenders who extend financing to the underserved MSME sector; however, the industry demand of scrapping the 18% interest rate cap on the scheme has not been clarified. The acknowledgment of PAN as a common business identifier as well for all digital systems is a laudable initiative as it will significantly reduce the compliance burden on small businesses that do not have the resources to maintain a large team who can maintain multiple numbers and filings. As digital lending picks up and NBFCs are increasingly offering niche products and services to the underserved credit segments and driving financial inclusion at scale. NBFCs are expected to see their AUM grow up to 12% in FY23 so it is important to differentiate the regulations between banks and smaller NBFCs and MFIs.

Subhrakant Panda, President, FICCI: The announcements capture the pulse of the economy while retaining credibility both in terms of projections as well as committing to the fiscal consolidation glide path. A push to investment and consumption is required to keep the growth cycle in motion. The thrust on capital expenditure, with a 33% increase in the capital outlay to Rs 10 lakh crore, is a step in the right direction. Revision in tax rates under the new regime will augur well on the consumption side. The government is committed to ensuring manufacturing competitiveness, ease of doing business, reducing compliance touchpoints, and supporting livelihoods across sections. We laud the government’s promise to make India’s exports competitive. In this context, some incentive to support exports would have been timely.

Internet and Mobile Association of India: The good work continues in form of simplification of the KYC and unified filing process by strengthening facilities under Digi Locker, which takes public digital goods to the next level. Digital Public Infrastructure for Agriculture, National Digital Library for Children and Adolescents, Bharat Shared Repository of Inscriptions (Bharat SHRI), online training platform iGOT Karmayogi, and the establishment of e-Courts, are programmes that will take the digital to the marginalised. Similarly, creating one hundred labs for developing applications using 5G services is another visionary initiative that will help build the use cases for the future. The relief in customs duty on the import of certain parts of mobile handsets and inputs such as camera lenses and the continuation of the concessional duty on lithium-ion cells for batteries for another year is welcome. The association is glad to note provisions for allowing startups to extend the date of incorporation for income tax benefits from March 2023 to March 2024 and provide the benefit of carrying forward losses on change of shareholding of start-ups from seven years of incorporation to ten years. However, IAMAI believes that there are certain persisting systemic challenges which impede the growth potentials of startups or even the ESDM sector in India.

PN Vasudevan, MD & CEO, Equitas SFB: It is a growth-oriented budget with a planned capital outlay and a higher allocation for the PM Awas Yojna Scheme, which would spur the housing finance market and all its upstream and downstream industries. It has a fillip for the rural economy in the form of higher fertiliser subsidies for the farmers, putting more money in their hands. The people at the lower end of the income bracket benefit from an increase in the minimum tax slab from Rs 2.5 to Rs 3 Lakhs, while for people willing to shift to the new tax regime, the minimum taxable limit has been increased from ₹ 5 to ₹ 7 Lakhs. This may spur more people to opt for the new tax regime. And at the top end of the income earners, the tax limit has been reduced from the current 42.7 % to 39%. Both of these should result in a higher level of disposable income and higher consumption. Overall, the budget scores on many fronts.

V Raman Kumar, Chairman of CASHe: It is a forward-thinking, balanced budget that gives particular attention to the financial industry. The risk-based KYC procedure as opposed to a “one size fits all” strategy is well appreciated. Expanding the scope of DigiLocker will benefit fintechs as it will simplify the KYC process and enable more significant digital investment and lending adoption. It will help bring down the customer onboarding cost and lead to ease of business. Introducing risk-based KYC will also encourage small ticket-size investors to sign up on investment platforms by doing a minimum KYC. Simplifying the KYC process will enable more significant digital investment, and lending adoption decisions will ultimately aid the fintech sector in better consumer acquisition and database analysis. CoE on AI will go a long way in learning and adopting AI in the country, giving impetus to the fintech and digital lending sector. Restructuring of the tax slabs is expected to boost savings in different asset classes and grow their investment portfolio.”

Yash Upadhyay, Chief Strategy Officer, 5paisa.com: A lot of focus has been given to digital infrastructure, agritech and fintech startups and green growth. Three centres of excellence for artificial intelligence just show the government’s focus on skill-building in upcoming technologies.

Vipul Shah, Chairman, Gem & Jewellery Export Promotion Council: Positive pro-growth move is that the conversion of physical gold into digital gold will not attract capital gains tax. The increase in the allocation for the Interest Equalization Scheme from to Rs 2,932 crore in 2023-24, up by 23%, will help in supporting exports, particularly by MSMEs and may result in increasing the subvention support as demanded by the exporters in view of rising interest rates. The enhancement of the Income Tax limit will benefit workers in the gem and jewellery industry. GJEPC thanks the government for accepting its recommendation to promote indigenous manufacturing in the emerging Lab-Grown Diamond (LGD) sector by providing Research Grants to IIT for five years. The industry had recommended reduction in import duty on gold/silver and platinum, which has not been considered.

Ashish Kumar Chauhan, MD& CEO, NSE: This is a growth-oriented budget, one of the best in years, with a focus on both infrastructure and job creation, while reducing income tax for pretty much everyone, and lots of money to states. No change in capital gains has also created a positive reaction. The budget would support growth and the Indian consumption story, keep us in good stead, given global headwinds in China and developed markets, and until the rest of the world eases. Overall, this is a very positive budget for the markets, with something for everyone. I give the budget 10/10.