In the third and last part of the 3-part report based on The 2020 McKinsey Global Payments Report, we discuss the prospects of merchant acquiring business in the wake of the pandemic:

The 2020 McKinsey Global Payments Report unequivocally states that the shift to electronic transactions has placed front and center the need for merchant acquiring companies to update and differentiate their service offerings. It states: “Globally, merchant acquiring has evolved over the past decade from a legacy processing and hardware business to a full-stack software and merchant services solution. This shift, coupled with the fragmentation of the merchant-facing payments value chain, is dramatically affecting the economics and business models of merchant acquisition as it was done in the past, favoring instead the value-added approach of the new merchant services players.”

The 2020 McKinsey Global Payments Report unequivocally states that the shift to electronic transactions has placed front and center the need for merchant acquiring companies to update and differentiate their service offerings. It states: “Globally, merchant acquiring has evolved over the past decade from a legacy processing and hardware business to a full-stack software and merchant services solution. This shift, coupled with the fragmentation of the merchant-facing payments value chain, is dramatically affecting the economics and business models of merchant acquisition as it was done in the past, favoring instead the value-added approach of the new merchant services players.”

The report points out that as acquirers shape their priorities for the next decade, the transformations spurred by 2020’s public health crisis will play a big part in the way they rethink their vertical focus, platform strategy, and investment priorities.

DIGITIZATION PROCESS

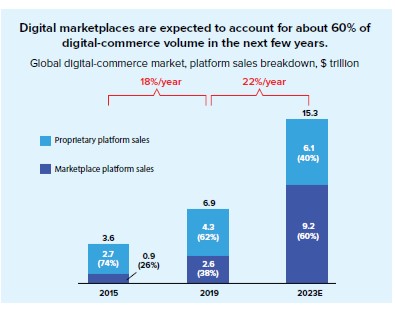

With the dramatic acceleration in shifts toward e-commerce and digital payments, there has been an unprecedented digitization of small-business commerce across geographies, mostly through marketplace platforms and these platforms have seen seller sign-ups increase by 70 to 150% since the start of the pandemic, while proprietary platforms are losing share, the report says and cites that in healthcare, there has been a surge in provider participation for services like telemedicine, which in turn is highlighting a growing need for B2C digital payments in professional services, education, and other areas. “This shift to digital is driving up merchants’ payments-acceptance costs, which are expected to rise by an incremental $8 billion to $15 billion (about 6 to 10%) as commerce migrates to these higher-cost channels. Just as importantly, merchants also face higher decline and fraud rates on digital transactions, with ramifications for customer experience,” it says.

Pointing out that digitization of commerce has created greater willingness to pay for enhanced services and solutions, the report states that merchants are willing to accept higher fees for demonstrated value, such as improved authorization rates, a more seamless payments experience, or improved cart conversion through point-of-sale financing. It also points out that leading acquirers are starting to transform in 2 distinct directions – adding targeted value propositions and becoming marketplaces themselves.

INVESTMENT IN TECH

The report says most large acquirers have invested heavily in core payment-enablement services, but relatively few have capitalized on the opportunity to deliver enhanced value-added services to large retailers. “Given the growing willingness of large retailers to pay for such services and to seek these from their current providers, this is a significant opportunity for current portfolio monetization and margin protection,” it says.

The report also finds that the acceleration of SME digitization has further underscored the value in the long tail. And most acquirers have targeted this opportunity through indirect distribution channels (eg, integrated software vendors and web-store providers), as scaling through direct channels poses a more complex challenge. “Regardless of the channel, however, SMEs have accounted for about three-quarters of all new revenue growth in the merchant-services space over the past 3 years, especially in established markets. Serving SMBs requires hyper-regional strategies for distribution and scale. In mature markets, acquirers are increasingly focusing on distribution through ISOs (independent sales organizations), ISVs (integrated software vendors) and other indirect channels, relinquishing 40 to 80% of revenue margins as residuals to their channel partners….Within the restaurant space, for example, at-scale food-delivery apps like Just Eats, Uber Eats and Zomato have gained scale, and transaction volume has shifted from the in-store ISV to the food-delivery applications, meaning those transactions are no longer processed by the restaurant’s acquirer or processor. Under those conditions, acquirers need to rethink their approach to partnerships and develop models that deliver more value to merchants through their ISV partners,” the report emphasizes.

FOCUS ON KEY AREAS

The report suggests that several key areas need focus as acquirers and merchant-services players reorient to prepare for the next decade:

- Investing to transform into a platform business for larger merchants.

- Investing in SME channels in emerging geographies to capture share.

- ‘De-cluttering’ infrastructure as the spate of acquisitions has led to often redundant data and software platforms.

- Aligning and simplifying organizations to mirror emerging and at-scale merchant profit pools and needs.

- Directing investments to digital ISVs and payments-adjacent offerings.

- Differentiating through data.

- Avoiding complacency on alternative payment methods.

- Rationalizing customer processes.

The report foresees the merchant acquiring industry likely seeing continued consolidation on the acquiring side and sustained fragmentation on the distribution side. “Growing commoditization of processing will need to be offset by improved sophistication of solutions and enhanced back-end efficiencies. Competing effectively will require scale not just across geographies and verticals but across solutions as well. As merchants across sectors rethink their acceptance and payments needs and journeys post-covid, the acquirers who orient themselves to innovate around these needs and journeys are best positioned to win,” it says.