Highlights of a study by BCG on the transformation of lending in India:

A recent study by Boston Consulting Group has come out with the conclusion that lending in India is poised for data-driven transformation and transactions will increasingly get digitized and available in bank statements.

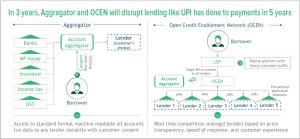

The study, titled ‘Honey, I shrunk the loans! Miniaturization of banking ticket sizes and the embedded future of banks: What does it mean for the winners of tomorrow?’ carried out by Saurabh Tripathi, Senior Partner, BCG, finds that aggregators will give access to machine readable bank statements and other data to any lender of customer’s choice and Open Credit Enablement Network, or OCEN, will create transparent competition on price and customer experience on digital platforms.

The study also says India’s embrace of open stack implies that, similar to payments, a significant share of customer interactions for lending will shift to digital platforms with customer traffic. In addition, there will be more frequent, context specific, low ticket loans, embedded banking.

Saurabh Tripathi says banks would need to prepare for this new reality in 3 ways:

– Master AI to draw real time credit insights from lots of data

– Develop muscles for managing partnerships with digital platforms

– Upgrade tech stack to keep pace with digital platforms

Some of the conclusions of the study in graphic formats: