A recent survey among lending organizations highlights the crucial role of alternative data and new technologies in credit decisioning by lending organizations:

A recent Forrester Consulting study done for credit information company Experian found that a vast majority – a high 82% – of respondents believed that their organizations need to improve the use of data and insights in business decision-making. The study also highlighted that alternative data and emerging technologies will drive credit decisioning in the consumer credit market in the future.

The study, done in the background of India’s economy recovering from the pandemic and as businesses continue to be impacted and consumers continue to grapple with the aftermath of salary cuts and job losses, stressed that as consumers apply for credit cards and loans to manage costs, lending institutions have the added responsibility of making accurate credit decisions. Nearly 65% of India’s lending companies surveyed for the study said wrong credit decisions can lead to financial losses, while 44% said such decisions can put customers in difficult situations. There is, therefore, need to focus on leveraging alternative data and emerging technologies.

The study surveyed 164 senior risk decision-makers from banking, fintech and non-banking lending organizations in India, Indonesia and Australia.

INNOVATION, NEW TECH

Some of the other key trends across the India lending markets found by the study are:

- Innovation and data utilization – the key to better lending

- Around 71% of those surveyed wanted their organizations to improve their ability to innovate. Most respondents believed that there is room for improvement in using data and analytics for credit decision-making.

- Embrace new technologies and improve data analytics capabilities

- While 82% of the respondents felt that their organizations should leverage more data from traditional sources, 80% believed that they should look for alternative data sources for more efficient credit risk assessment. These numbers indicate that employees feel that their organizations are not utilizing available data optimally.

- Around 82% of respondents felt that they could improve data and analytics capabilities, and nearly 84% felt that there was an urgent need to embrace emerging technologies like AI for credit risk assessment and management.

- Unfortunately, only 36% of respondents felt that limited data standardization was a major barrier to increasing automation in credit decisioning for lending organizations. Also, 66% felt that legacy systems and dependence on manual processes were preventing organisations from turning to automation.

- Some 42% of respondents believed that their organizations are using alternative lending data to make effective credit decisions. While the use of alternative data in credit decisioning is still gradually being adopted, there are positive signs that this is picking up, with around 67% of respondents feeling that investing in real-time data and analytics will be the top priority of their organization over the next 1-3 years.

Automation – a long way to go

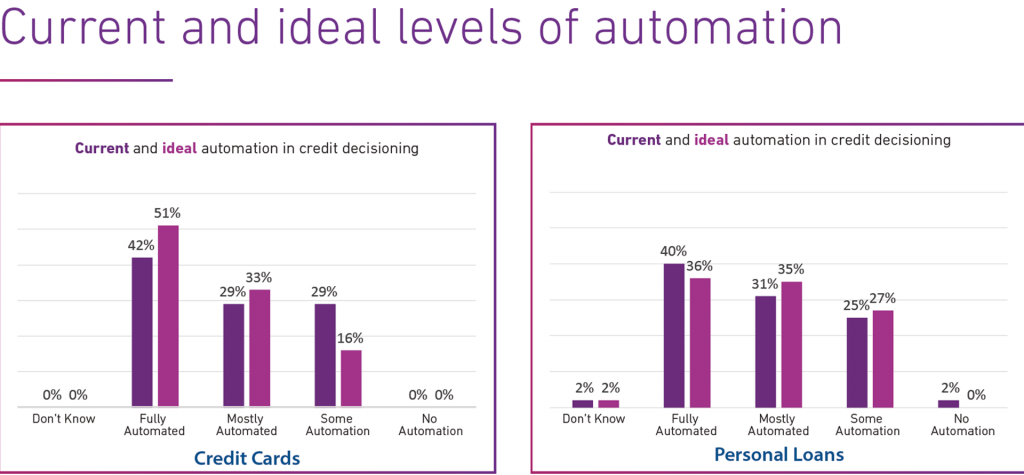

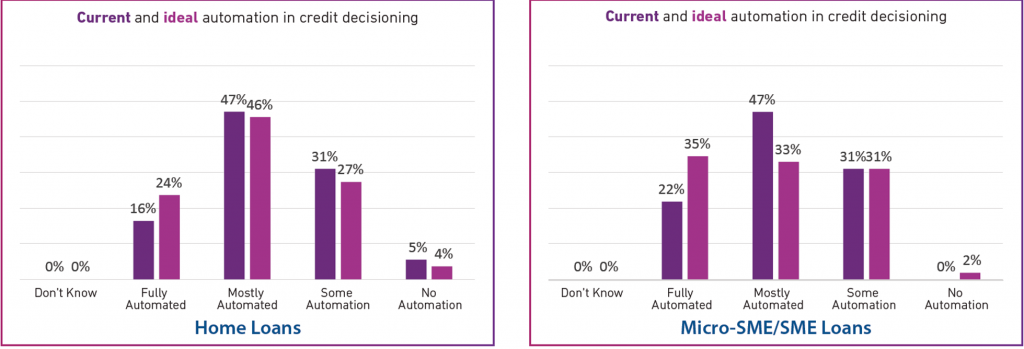

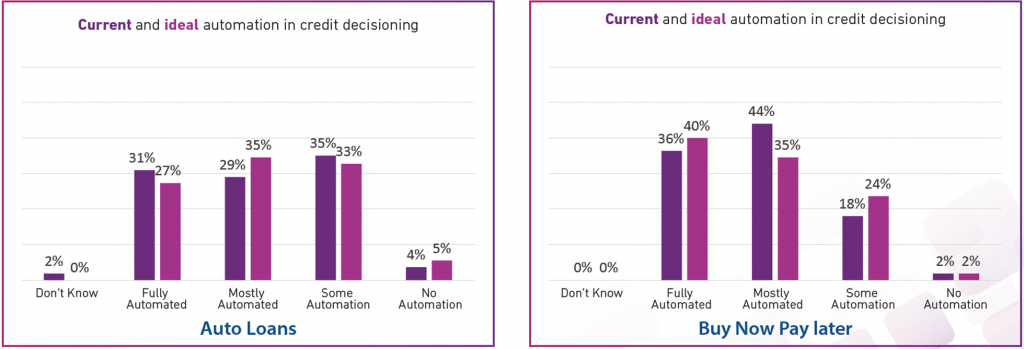

The study highlighted how automation is being used in credit decisioning across various lending products:

- Credit Cards: full automation: 42%; partial automation: 58%

- Personal Loans: full automation: 40%; partial automation: 58%

- Full automation in other loans: auto loans: 31%; MSME loans: 22%; home Loans: 16%

ROLE OF AUTOMATION

Neeraj Dhawan, Country Manager, Experian India, says, automation can shorten the sales cycle and improve the quality of service offered to customers, and should be a priority for businesses to stay competitive in the current credit landscape.

Neeraj Dhawan, Country Manager, Experian India, says, automation can shorten the sales cycle and improve the quality of service offered to customers, and should be a priority for businesses to stay competitive in the current credit landscape.

The study felt that leveraging data sources such as payroll data, alternative lending data, buy-now-pay-later services data, subscriptions data, tax filing data and social media data can help lending organizations make more informed decisions, prevent fraud and reduce credit risk.