Apps and portals enable government schemes:

SB Singh points out how his bank incentivizes onboarded vendors with a monthly cash back in the range of `50-`100

The covid pandemic and the repeated lockdown restrictions all of sudden have led to the daily laborers, street vendors, small shopkeepers and the like losing livelihood. The gradual withdrawal of lockdown notwithstanding, they have largely remained jobless and without any means to restart their activities. In order to help this highly vulnerable section of the society, the central government has started the Prime Minister’s Street Vendor Atmanirbhar Nidhi, or PM SVANidhi, scheme, under which these sections of the society an obtain working capital loan of up to Rs10,000 to enable them restart their activities and earn their livelihoods.

According to S. B. Singh, Chairman, Aryavart Bank, a RRB headquartered in Lucknow, these unforeseen circumstances have forced this section of people to divert their small savings or self-contributed working capital to support their families during the tiring times of the lockdown thereby impacting their earning potential adversely. It is most likely that they would have fallen into a debt trap after having to depend on moneylenders and large traders. In this situation, PM SVANidhi is the ideal scheme to help them with working capital loans and support them to restart their economic activities in a smoother way, he says.

Street vendors represent an important constituent of the urban informal economy and play a significant role in ensuring availability of goods and services at affordable rates at the doorsteps of the city dwellers. The goods supplied by them include vegetables, fruits, ready-to-eat street food, tea, pakodas, breads, eggs, textile, apparel, artisan products, books/ stationery etc. The services include barber shops, cobblers, pan shops, laundry services, etc.

Dr N. Muralidhar, Managing Director, Telangana State Cooperative Apex Bank, explains the pain they had to undergo: “The pandemic and the lockdowns have adversely impacted the livelihoods of these street vendors. With their meagre capital, which is mostly borrowed, having been fully wiped off, their situation pitiable. They usually work with a small capital base and might have consumed the same during the lockdown. Therefore, there is an urgent need to provide credit to street vendors to resume their business. The government, having recognized the situation, has brought in good number of packages to revive the economy.”

INTEREST SUBSIDY

Banks would continue to charge interest as per prevailing similar schemes. However, in case of NBFCs, NBFC-MFI, etc, interest would be charged as per RBI guidelines. The vendors, availing loan under the scheme, are eligible to get an interest subsidy of 7%. The interest subsidy amount will be credited into the borrower’s account quarterly.

B. Singh says: “Aryavart Bank is charging 9% p.a. for loans sanctioned under PM SVANidhi scheme. On timely or early repayment, the vendors will be eligible for the next cycle of working capital loan to an extent of Rs20,000 with an enhanced limit.”

Subsidy will only be considered in respect of accounts of borrowers, which are ‘Standard’ (non-NPA as per extant RBI guidelines) on respective claim dates and only for those months during which the account has remained standard in the concerned quarter.

N. Muralidhar mentions that Telangana SCB is promoting digital payments by generating a QR code/VPA for street vendo

DIGI TRANSACTION INCENTIVE

The scheme incentivizes digital transactions by the street vendors through cash back facility. The network of lending institutions and digital payment aggregators like NPCI (for BHIM), Paytm, Google Pay, Bharat Pay, Amazon Pay, PhonePe, etc, will be used to on-board the street vendors for digital transactions. S. B. Singh elaborates: “The on-boarded vendors would be incentivized with a monthly cash back in the range of Rs50-100 as per certain criteria: On executing 50 eligible transactions in a month: Rs50, on executing the next 50 additional eligible transactions in a month: Rs25 and on executing the next additional 100 or more eligible transactions – Rs25. Here the eligible transactions mean a digital payout or receipt with minimum value of Rs25.”

Muralidhar says the Telangana State Apex Cooperative Bank has been promoting acceptance of digital payments by the street vendors, generating a QR code/VPA for them. The details of the same has to be filled up in the portal, without which the branch managers cannot go ahead with the disbursal.

RS45 MN DISBURSED

Aryavart Bank has been servicing 26 districts of Uttar Pradesh through a network of 1367 branches. It has received 16,028 loan applications, amounting to Rs160.28 million, out of which 6410 applications have been sanctioned. S. B. Singh says the bank has disbursed Rs45 million as on 30 November in respect of 4504 loan applications. The pending applications are under process and these would be sanctioned at the earliest.

840 LOANS

Muralidhar says his bank, through its 42 branches, has issued 840 loans to the street vendors up to 15 December and the bank is taking forward the scheme as a part of social responsibility. The bank has stipulated maximum loan repayment tenure of 12 months. Recovery is on monthly basis/daily basis, as per borrower’s convenience. The bank has supported several vendors, including those selling vegetables, fruits, ready-to-eat street food, tea, pakodas, breads, eggs, textile, apparel, artisan products, books, stationery, etc.

UDYAMI MITRA PORTAL

The Town Vending Committee (TVC)/ Urban Local Bodies (ULBs) play a key role in the identification of beneficiaries under PM SVANidhi. Applications of the interested and eligible vendors are forwarded by the TVC/ ULBs to respective banks through Udyami Mitra portal managed by SIDBI. The lending institutions and their branches using their login ids, pick up the applications forwarded in their branch IDs. Says B. Singh: “SIDBI leverages the network of lending institutions including SCBs, RRBs, SFBs, cooperative banks, NBFCs & MFIs for the implementation of the scheme using its Udyami Mitra portal. Branches after contacting the vendors sanction picked up applications on Udyami Mitra portal itself. Further, disbursement of the loan is also updated on Udyami Mitra portal. The monitoring of the progress is being done by the State Level of Bankers’ Committees (SLBC), DIF and other government agencies at state as well as by a steering committee under the chairmanship of secretary, HUA at the central level.”

API INTEGRATION

The API integration between PM SVANidhi and the State Bank of India’s portal has been taken up to ease the process of receiving and processing loan applications and to facilitate seamless flow of data between PM SVANidhi and SBI’s eMudra portal in a secure environment and expedite the loan sanctioning and disbursement process.

Durga Shanker Mishra, Secretary, Ministry of Housing & Urban Affairs, had launched the API integration between the said two portals. The ministry would be exploring similar integration with other banks as well for which a consultative meeting will be held shortly.

PORTALS-APP INTEGRATION

An IT platform integrates the web portal/mobile app with Udyami Mitra portal for credit management and PAiSA portal of Ministry of Housing and Urban Affairs to administer interest subsidy automatically. The scheme incentivizes digital transactions, ie receipts/ payments using digital means like UPI, QR codes of payment aggregators, RuPay debit cards, etc, by the street vendors through monthly cash back. Durga Shanker Mishra has said the ministry is working with all concerned stakeholders to make the process smooth and effortless to realize the objective of Atmanirbhar Bharat.

Hardeep Singh Puri, Minister of State in-charge, Housing and Urban Affairs, while reviewing the implementation status and progress of PM SVANidhi Scheme, said this is a positive step towards the making of an Atmanirbhar Bharat.

Urban local bodies are playing pivotal role in the implementation of the scheme. They are leveraging the network of all stakeholders namely street vendors’ associations, business correspondents/ agents of banks/ micro-finance institutions, self-help groups and their federations, digital payment aggregators in administering the scheme successfully.

SWIGGY SUPPORTS 36K VENDORS

Online food distribution platform Swiggy has expanded its street food vendors program to support 36,000 people in 125 tier 2 and 3 centers. After a successful pilot with the Ministry of Housing & Urban Affairs in Ahmedabad, Varanasi, Chennai, Delhi and Indore, Swiggy onboarded more than 300 street vendors on its platform. The ministry and Swiggy ran a pilot program by on-boarding 250 vendors. The street vendors were helped with PAN and FSSAI registration, training in technology/ partner app usage, menu digitization and pricing, hygiene and packaging best practices. The plan now is to expand this initiative across the country in phases. This partnership is seen as yet another move by the ministry to empower street vendors with digital technology and facilitate greater income earning opportunities by being present on a popular ecommerce platform like Swiggy.

Swiggy has formed a team to discover and recognize street vendors on the platform. The business has also developed a special app destination where customers can discover their favourite street food suppliers.

Vivek Sunder, COO, Swiggy says: “As a platform we are dedicated to safely and hygienically delivering the widest range of food to the doorsteps of customers.”

Swiggy provides 1-on-1 interactive training and brings street vendors through the process of obtaining, planning, and fulfilling orders on the platform without sacrificing the experience of the customer. The ministry has entered into an MoU with Swiggy to onboard street food vendors on its ecommerce platform, giving them online access to thousands of consumers and help these vendors grow their businesses.

CREDIT LINKAGE, FACILITIES

Aryavart Bank has expanded its activities in semi-urban and urban centers too. S. B. Singh says in order to fulfill the socio-economic objectives of sustainable rural development in the bank’s command area, the bank is continuously promoting various Government of India sponsored schemes and other programs put together for development and promotion of agriculture, trade, commerce, industry and other productive activities in rural areas. This includes credit linkage and extension of other banking facilities, particularly to small and marginal farmers, agricultural laborers’, artisans, small entrepreneurs and street vendors.

PRACTICAL DIFFICULTIES

PRACTICAL DIFFICULTIES

Muralidhar mentions a difficulty “Since many of the street vendors lacked smart phones, it has become difficult to process the loans. Although branch managers could disburse loans by generating QR codes through various alternatives, it is a time-consuming process. The applications uploaded by the street vendors on the portal expire within certain period of time. Without having the knowledge on this aspect, many of the street vendors are approaching the branches late and they had to reapply for the loan, as the previous loan applications are not visible/retrievable on the portal.”

The lending institutions also face some other issues. S.B. Singh points out that sometimes an applicant could be residing out of the service area of the branch where the application has been forwarded by Town Vending Committee (TVC)/ Urban Local Bodies (ULBs). There are also cases where the applicants already have to account for NPAs.

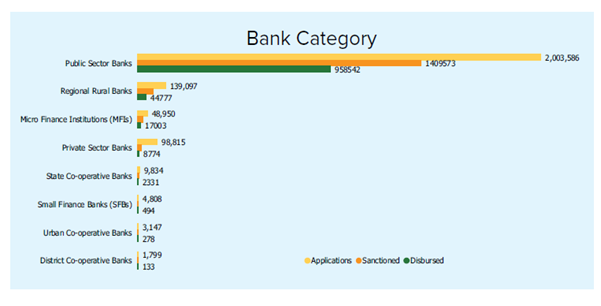

AGGREGATE LENDING Rs12.29 BN

He also indicates that the way applications are accepted and subsequently processed and decided by the lending institutions in record time has ensured credit linkage of approximately more than 3 million street vendors across the country by 3 January 2021, ie within 6 months of the launch of the scheme. In Uttar Pradesh, lending institutions have credit linked more than 300,000 street vendors so far, which is the highest among all the states in the country.

Out of the aggregate 16,95,518 sanctioned loans at the national level, disbursal has taken place in the case of 12,40,376, with Rs12.29 billion being the disbursed amount. Some 147,735 branches of banks/financial services institutions have onboarded for the purpose.

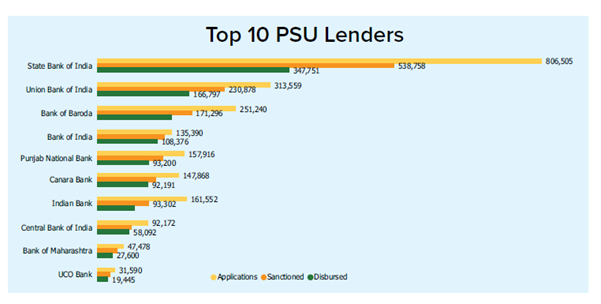

SBI ON TOP

SBI ON TOP

SBI tops the list of PSU banks as of 3 Jan 2021 , with the highest disbursal of 347,751 loans (against 806,505 applied and 538,758 sanctioned), followed by Union Bank of India, Bank of Baroda, Bank of India and Punjab National Bank. Among the top 10, UCO Bank has received the least number of loan applications – 31,590 . While out of more than 3 mn applications to banks, the least number of disbursed loans, as of 3 December 2020, are by state cooperative banks (2331), small finance banks (494), UCBs (278) and DCCBs (133).