Another South-based bank, Canara Bank, is in the midst of an organizational transformation. Rakesh Sharma, MD and CEO of the bank, explains the roadmap that has been created for the purpose:

Mohan: How does Canara Bank take care of the key issues like customer care, ease of doing business, technology efforts and profitability so that it makes a difference? Is the focus more on retail business or on corporate?

Rakesh Sharma is aiming to make Canara Bank a knowledge based bank by converting heterogeneous data into information

Rakesh Sharma: Canara Bank today is one of the premier commercial banks in India, having its origin more than a century ago in 1906. Since then, the bank has grown from strength to strength and at present it has an elaborate branch network – 5849 branches – and 9251 ATMs. This is the highest number among nationalized banks.

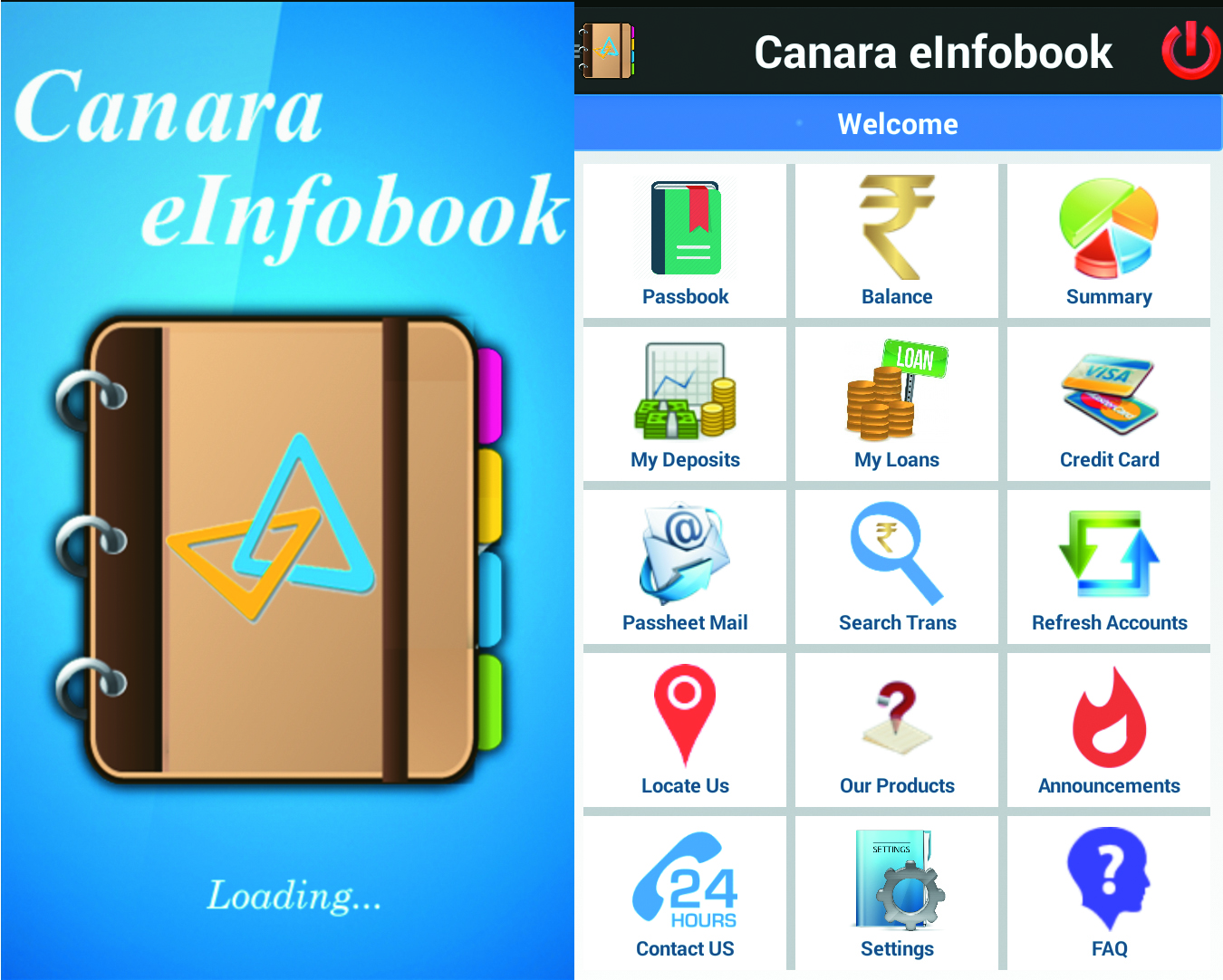

True to its founding principles, the bank has always remained a customer focused bank. It has been undertaking a slew of innovative initiatives and measures to remain customer centric, be it in the IT front or in the new products and processes. These initiatives have been improving customer satisfaction and enhanced fast delivery system. To take a few examples, instant in-principle sanctions for home and car loans, loan application and tracking systems, updated net and mobile banking applications, eInfobook, mWallet, customer grievance redressal system etc, are some of the innovations in IT, which are increasing customer satisfaction.

Given its elaborate branch network, we are focusing on growing our retail business – mobilizing retail deposits and deployment in retail assets like agriculture, MSMEs, housing, vehicle, education etc. We are able to grow our customer accounts to over 7.25 crore, and this is growing day by day.

Can you talk about the human capital in the bank? How ready are you in terms of people to take on the fierce competition that is there in the banking domain? What are the measures that are being initiated in order to make the personnel perform in a competitive environment? Is training a focus area?

One of the biggest challenges for banks today is human capital. With the fierce competition among the banks in public and private sector, there is an urgent need to keep the staff ready for facing any competition that comes along. We at Canara Bank have in place a robust HRD system, which continually meets the training needs of the staff, compartmentalized into 4 genres of activities – Internal Training, External Training, In Company Training and Foreign Training. Internal training is handled exclusively by our Staff Training College, along with the entire array of 23 Regional Staff Training Colleges, which takes care of the entire training process right from identification of officials to posting them for various trainings in different disciplines. Focused and need based external trainings at various institutes of repute are also given.

Our prime aim is to keep our staff skilled and updated to face the competition at the industry level. During the last four financial years ending March 2016, we have recruited more than 24,500 employees. Our staff profile is getting younger and they are the real assets for us to forge into new growth frontiers. The average age of employees as on 31 March 2016 is 41 years.

What are your turnover targets for the coming 3 years? What customer segments according to you will fuel most of the growth?

The bank has crossed Rs8 lakh crore business as at March 2016, comprising Rs4.8 lakh crore under deposits and Rs3.25 lakh crore under advances. The industry is growing at little over 10% yoy at present. Being a large PSU bank in India, we have kept our growth at above 12% for FY2016-17. Our retail assets segments are continuing to register good growth yoy like, priority credit (23%), agriculture (14%), MSME (10%), retail lending (27.8%), including housing loans (38.6%) as at March 2016. We are confident that with the turnaround in the private corporate sector in FY2017, it would be feasible for us to sustain the double digit growth in the next three years. We have been reorienting our focus on growing retail segments, which shall continue to get the attention in the medium term also, including agriculture, MSME, and lending to various retail segments like housing, vehicle, education and other personal loans.

The emphasis will also be on marketing quality corporate business with efficient risk management. We had a 3-tier organizational structure for both retail and corporate business. We have gone for an organization restructuring system thereby putting up 4-tier structure for retail, SME and agriculture to improve on customer connect and staff connect. For corporate business, we have introduced 2-tier system to ensure faster delivery and monitoring mechanism. At present, we have 12 Prime Corporate Branches (PCBs) which now directly report to the head office. We propose to increase the number of PCBs to 15 shortly. Similarly, for effecting faster recovery of NPAs, we have created a separate vertical for asset recovery and management branches.

Canara Bank has branches in London, Hong Kong and Shanghai as well as representative offices in major world capitals. Do you intend to expand this operation? If so, which are the markets which will be initial targets?

At present, we have overseas footprint in 9 countries, which include branches in London and Leicester (U.K), Hong Kong, Shanghai (China), Manama (Bahrain), Dubai International Financial Centre (DIFC) (U.A.E), Johannesburg (South Africa) and New York (U.S.A); a representative office at Sharjah (U.A.E) and a joint venture bank, viz., Commercial Indo Bank LLC in Moscow (Russia) in association with State Bank of India. A new subsidiary has also started commercial operations at Dar-es-Salaam in Tanzania from 9 May 2016.

As of now, our overseas branches are contributing 6.32% to our total business. We are aiming to take this to about 10% in medium term. We have approval from the RBI for expansion in another 5 international centers such as Frankfurt (Germany), Sao Paulo (Brazil), Tokyo (Japan), Jeddah (Saudi Arabia) and Jakarta (Indonesia), which shall be explored for expansion.

Can you give highlights of the bank’s treasury operations? What is the volume of business in general?

Our aggregate investments (net) reached a level of Rs142,309 crore as at March 2016. The yield on investments was 7.92% as at 31 March 2016. Despite a fall in yield, our trading profit under domestic treasury operations has been a handsome Rs990 crore during the year ended March 2016. We are an active player in the Government Securities market as a primary dealer, which shall be continued going forward.

We also have a significant portfolio in the foreign business turnover, aggregated to Rs201,860 crore as at March 2016, comprising Rs98,767 crore under exports, Rs54,047 crore under imports and Rs49,046 crore under remittances. Our aim is to churn out maximum volume to reap benefit from the segment.

How much is the bank’s total spent on information technology? In percentage terms to its turnover?

Canara Bank’s total business stood at Rs8.05 lakh crore as at 31 March 2016. The bank has always been an IT savvy organization and has pioneered various IT initiatives. As such, the IT spent of the bank over the years has always been in sync with the IT roadmap and vision of the bank.

What are the technology transformation tasks the bank has on hand at the moment? Can you give the details?

As you know, Canara Bank has always been proactive in implementation of technology in various areas of its operations and offering the latest digital services to its customers. It has been constant endeavor for us to harness new technology breakthroughs and digital solutions for improving productivity, efficiency, security and customer and employee satisfaction.

We are a future ready bank having our own detailed digital strategy with reliable and scalable infrastructure in place. Our CBS version upgradation process is in progress. We are in the process of opening hi-tech self-service branches, equipped with complete banking solutions through digital devices, aiming to provide end-to end digital experience to customers. We are also in readiness to be part of the Unified Payment Interface, an initiative of NPCI for providing universal electronic payment services to our customers. We propose to provide geo-mapping facility for our customers, wherein the customers can locate the nearest branches/ATMs/e-Lounges and other specified locations in map with an option for suggested direction routes to reach the desired location. As part of our green initiative, a new digital document management system is also proposed. Many other digital initiatives like e-Sign, e-Learning, payment hub etc are also in the pipeline.

Which are the core areas that you focus in this technology transformation – digital as a whole, mobility, self-service and customer delight?

As all of us know, the customer expectations have increased many folds in the recent past. Intense competition among the banks has redefined the concept of the entire banking system. Banks are looking for new ways not only to attract but also to retain the customers and gain competitive advantage. The technology and digital services offered to them constitute one of the major differentiating factors now. The aim of digitization is to improve organizational efficiency, secure data and provide customer delight with banking services provided at their fingertips. Many of our new tech initiatives like mSecure, eInfobook, new versions of mWallet, internet and mobile banking have propelled our digital transactions growth to 57% yoy. As part of making our customer centric digital packages popular, we have ensured that these are device compatible in all major technology platforms and mobile devices.

Is the bank according to you prepared technologically to take on the competition that is evolving in the banking domain at the moment? Can you elaborate?

The Indian banking industry has seen an aggressive implementation of digital solutions by new and established financial / retail entities. We are aware about the changing situations and challenges and have taken many proactive decisions to mitigate the same. With stabilized CBS architecture and multi-channel infrastructure in place, we have introduced a number of digital solutions. We have revamped our mobile banking and internet banking applications recently to make them at par with the market trends. We have also implemented a number of digital solutions for improving our operational efficiency along with regular upgradation of our digital infrastructure and software in line with the business needs. Canara Bank, I can say, is a future ready bank having its own detailed digital strategy with reliable and scalable infrastructure in place.

Where do you see the bank say in five years from now in terms of technology induction? Will this usher in a paper less bank ultimately?

With more digitization of banking services happening, the future will be for paperless banking. Our vision is to establish an information, communication and technology infrastructure, which is the best in the industry and to transform the bank into knowledge based bank for bringing customer delight, improving operational efficiency, enabling automated, integrated and reliable and real time decision support system for all our stakeholders. We will leverage the massive heterogeneous data across all systems for converting it into information and transform the bank into a knowledge based bank. We will also aim to have a multi-pronged approach to IT involving people, process and technology with empowered and efficient IT governance framework in place. As part of our green initiatives we are moving towards digitization of documents and also providing eKYC portals to our branches.

Do you think it is relevant to initiate technology projects keeping in mind the fact that ultimately it is the mobile that is going to be preferred medium of transactions?

Mobile is already a preferred medium of transaction and going forward it will be more prominent. The mobile phone is one of the widely accepted channels for communication and getting information in your fingertips. The mobile phone reach is phenomenal with over 100 crore mobile connections in India, and there is further scope as only 10% of the market is tapped. The mobile will play a key role in reaching the rural mass and in implementation of financial inclusion plans of our government so that the banking services are readily available to the entire nation. We have revamped and released the latest version of mobile, internet banking, and mWallet recently with enhanced customer friendly features, which is on par with industry standards.

Have digitization efforts suffered at any point of time because of your being a public sector organization?

No, whether public or private, all sectors have their own set of challenges. We have an IT policy in line with our corporate policy which are guided by RBI and government directives.

What are the plans for mobile money? Do you indent to launch a mobile wallet? Have your customers expressed desire to have p2p fund transfer facility provided by the bank?

Mobile wallet (m-Wallet) and P2P fund transfer facility is already in place. The first phase in mobile banking was to provide basic banking transactions like balance enquiry, mini statements, funds transfer etc. The future will be mobile commerce where in customers can make purchases/payments through mobile commerce. With high mobile penetration, mobile will be the preferred channel for urban as well as rural customers.

Do you think with mobile revolution happening, internet banking will lose its current status as the most preferred channel among the GenNext customers?

Mobile and chip based banking will be the future. In terms of number, mobile banking transactions have overtaken the internet banking transactions and in future with a more secured mobile banking platform in place, high value transactions also will start happening through this channel. It is evident that technology has been evolving as per the market trends and customer demands at the fast pace.

Can you speak about the products and services that you offer to your corporate clients making use of technology? Is the bank planning to have mobile banking facility to corporate?

Corporate internet banking with enhanced features is enabled for our corporate customers. Apart from NEFT/ RTGS payment facility, fund transfer using MMID (Mobile Identifier), tax payment etc are also available. We are in the process of adding more features to our corporate internet customers. A supply chain management solution is also in place providing high end technology to create an integrated procurement and distribution mechanism coupled with matching payment dispensation and collection systems to our corporate clients.

What are the new security systems that you intend to implement as you proceed with your digital initiatives?

We are in the process of implementing a Security Operations Centre SOC) for dealing with information security issues at an organization level with continuous monitoring of events / data from security aspects providing better monitoring and management of security threats. This facility will take care of Security Information and Event Management (SIEM), Privileged Identity Management (PIM), Database Activity Monitoring (DAM), Automated Vulnerability Assessment Scanners and Proxy and Internet Gateway Solution.

Is the bank considering virtualization technologies? If yes, what are the priority areas?

Yes, virtualization is the future trend and we are in the process of finalizing our server and storage virtualization. It will help us to adopt industry standards and for better utilization of hardware resources. It will help us reduce capital and operating cost, improve business continuity, improve responsiveness and easy upgradation, besides easy monitoring and maintenance.